Paying close attention to learn the nuances of an Effective Financing Statement (EFS) filing ensures capable interests in farm products. Using the Legal Information Institute’s § 1631(c)(4) as an inspiration, this in-depth Q & A guide will cover all of the important aspects you need to know about when it comes down to EFS filing and keep you on track with confidence.

What is an Effective Financing Statement (EFS) and how does it differ from a UCC Financing Statement?

Understanding the purpose of an Effective Financing Statement

The EFS is a critical to perfecting security interests in farm products. An EFS is different from a normal UCC financing statement because an EFS has been crafted to safeguard secured parties that own agricultural collateral. The central function of an EFS is to indicate potential purchasers that a security interest in farm products exists, thus preserving the rights of creditors and other secured parties.

The EFS is critical to the agricultural lending industry as it ensures that lenders are able to retain their security interest in farm products after sale. Because the UCC document is a “financing statement,” this particular type of financing statement, in states where an agricultural lien can be filed and recorded centrally to notify all interested parties — typically used for farm products subject to changeable inventory levels could help confirm that heavily collateralized soybeans or sunflowers are not sold without secured-party approval.

Key differences between EFS and UCC Financing Statements

EFS and UCC financing statements achieve security interest perfection but they are similar in form only. A UCC financing statement is for all types of collateral or an EFS that only applies to farm products. EFS advises a security interest in farm products must be more specific as to the description of and crop year for, but provides no other guidance or elective method.

One major variance is the filing of a bankruptcy location. Filing Process: UCC financing statements are typically filed with the Secretary of State, while EFS full or partial scaling filings may be submitted to specialized central filing systems in some states. An EFS also has a life span unrelated to the UCC financing statement, that is often shorter and needs more continuation statements in order for it be considered effective.

| Aspect | EFS | UCC Financing Statement |

| Purpose | Specific to farm products | Covers broader range of collateral |

| Information Required | More detailed, includes crop years | Less specific |

| Filing Location | May use specialized central filing systems | Typically with Secretary of State |

| Effective Period | May differ, often requires more frequent continuation | Usually 5 years |

Legal requirements for EFS filing under § 1631(c)(4)

There are strict statutory requirements for EFS filing under § 1631(c)(4) that must be followed closely. In this case, the law explained what was required to be included in a financing statement for it to be effective (which is addressed later on). Name, address and social security number or other identifying information for a debtor also must be provided on the EFS.

Additionally, the EFS has to contain specifics from a secured party (that is its name and address). The farm products subject to the security interest must also be described in detail, detailing crop years. These are legal requirements and compliance is essential to ensure that an EFS remains effective and the secured party’s interest in the defined farm products securing it.

How do I properly file an Effective Financing Statement for farm products?

Step-by-step guide to filing an EFS

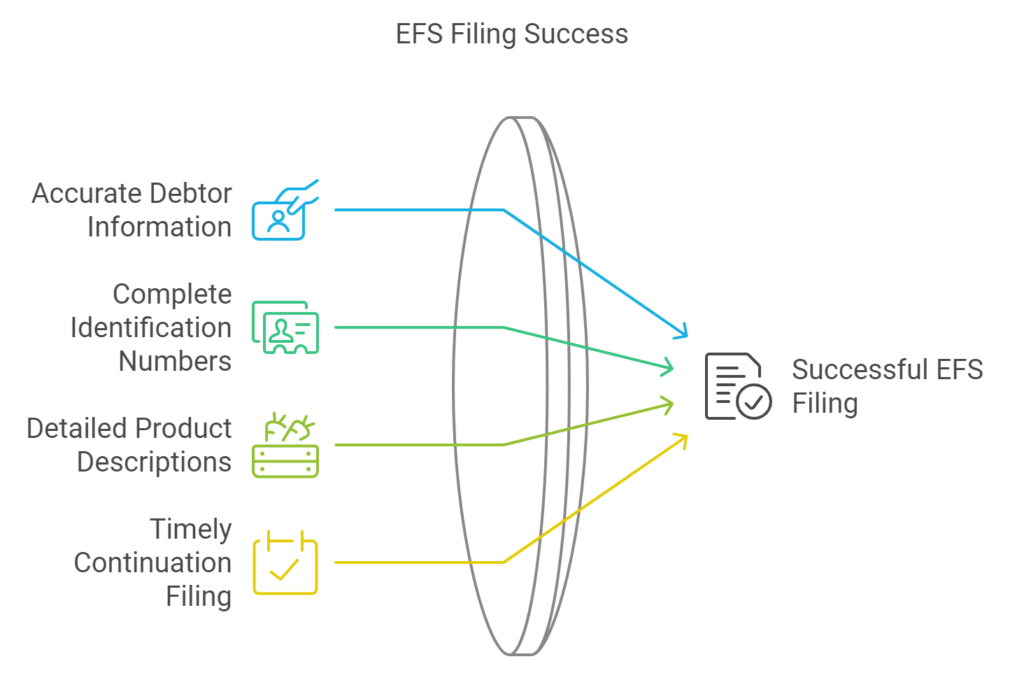

An EFS for farm products must be completed with extreme attention to detail and observance of procedural requirements. First, get the correct EFS form from your state central filing system or at an office of the Secretary of State. Fill out all the required information correctly, and make sure to use exact real legal name address number social security or another that established by law.

Then, type in information on the secured party like name and address. A description is adequate if it identifies the farm products covered, including crop years where appropriate. Verify all information and ensure there are no errors because if this EFS does not work accurately. Send the completed form to the correct filing office with any necessary fees. Retain a copy of the filed EFS for your records and record when they will expire so that you can make sure to file continuation statements at the appropriate intervals.

Required information for a complete EFS filing

For your EFS filing to be fully effective you need more than just filling the form out, as it needs other key pieces of information. You will also need the full legal name, address and social security number (or other approved identification number) of your debtor. The name and address of the secured party must also be noted prominently. It is important to have a detailed description of the farm products that are covered under the security interest, including specifics on types and crop years.

| Category | Required Information |

| Debtor Information | Full legal name, Address, Social Security Number or other ID |

| Secured Party Information | Name, Address |

| Farm Products Description | Detailed description, Crop types, Livestock info, Crop years |

| Security Agreement Details | Date of agreement, Other relevant details |

| Additional Information | County codes, Product codes (as per state requirements) |

Further the EFS shall also incorporate a date of security agreement and other relevant information pertaining to the knowledge about ascertaining an entitlement. Remote shopping is only available under certain circumstances, and extra information such as county codes or validations for products may be required in some jurisdictions. Before filing an EFS you should consult with your state and § 1631(c)(4), to include all the necessary information in your submission.

Common mistakes to avoid when filing an EFS

Secured parties need to be aware of the common mistakes that occur when filing an Effective Financing Statement. A common error is leaving out details on the debtor such as misspelling their name, or using nicknames instead of legal names. An additional major mistake is to forget the debtor’s social security number or other legitimate identification number, since this will make the EFS ineffective.

However, secured parties tend to neglect specifics in the description of farm products subject wholly or even partially continental shelf. More specific or general descriptions may not adequately serve their interests. Finally, it can mean a continuation statement is not filed within the needed time limits and subsequent expiration of an effective period. Recording the filing dates and setting reminders of renewal deadlines so that there would not be absent minded lapses in security interest protection.

What information must be included in an Effective Financing Statement?

Debtor’s full legal name and address requirements

Key Elements of an Effective Financing Statement (EFS): The EFS must identify the debtor by its full legal name and address. It is important to use the debtor´s full, complete legal name – do not include nicknames or abbreviations. The location given should be the house or regular workplace of a debtor. This information must be completely accurate as any minor details that do not match could cause the effective period of this statement to expire!

The creditor is also required to provide the debtor’s social security or alternative identification number in addition to name and address. This allows you to define a specific debtor and avoid confusion with others who have the same name. Maps for Work accounts can use a tax identification number or other form of local business ID in some regions. You will need to confirm the specifics as they pertain to your state’s central filing system.

Secured party’s information and security interest details

The EFS will include the name and address of the secured party. The information is pivotal for an owner who has their personal property used as security to reach the secured node if someone buys or shows interest in obtaining a part of the factored stored goods. This should include all relevant names and addresses if there are multiple secured parties. Be Sure to List the Secured Party That Filed the Statement Under UCC Article 9 AND is responsible for maintaining/monitoring EFS

The EFS must describe the security interest correctly. This should include the date of the security agreement, and any other information about what type of a security interest? Although it’s not mandatory to recite the entire security agreement, there must be enough detail description of what is being claimed and its source that a third-party reader would have notice about where specific farm products listed on Schedule F came from.

Farm product descriptions and crop year specifications

A well drafted EFS will include a detailed inventory of the farm products covered by the security interest. The description can be very specific and may detail the crops, types of livestock, or agricultural products on which lien is granted. Crops, because they are seasonal and subject to variation from year-to-year in conjunction with the continual planting of crops by a producer The crop years covered help define what is included within scope and duration that the secured party’s claim may be asserted.

In certain situations, more details are needed including the geographic position of the farm products and individual identification numbers for livestock. The amount of detail you need is going to be different from state requirements and also the farm products. By providing necessary information needed, secured parties must make an automatic effort to help the EFS afford comprehensive protection for their security interests in farm products;

How long does an Effective Financing Statement remain valid?

Understanding the effective period of an EFS

One element that secured parties must keep an eye on in order to properly perfect security interests, is the duration of effectiveness for an Effective Financing Statement (EFS). An EFS is often valid for a certain period, usually five years from the date of filing (just like regular UCC financing statements). That being said, bear in mind that this time frame of effectiveness differs among different state regulations and the type of farm products at stake.

A statutory notice regarding the security interest in certain farm products is filed no more than 90 days before that date or, if another EFS has been effective for those farm products during all times since it was filed, within six months after issuance of a continuance. The secured party retains its priority interest in the assets subject to certain rules during the life of an EFS. Secured parties must be vigilant about the EFS termination date to maintain protection of their interest in the farm products covered by FSA security agreement.

Filing continuation statements to extend EFS validity

Secured parties must file extension statements in order to keep an EFS effective past the initial period. Such continuation statements must be filed prior to the Steele Closures EFS expiration (i.e. around six months before end of an effective period). Precisely when the notice must be sent will differ among jurisdictions, so here again one should check with local law or guidance from §§1631(c) (use 4) for this aspect.

Secured parties must update an original EFS through a continuation and any changes in the information contained in the initially filed financing statement are accomplished by filing a continuation. For example, there may be amendments made to the information about the debtor; modifications of the farm products covered by a security interest or alterations in identifying details of secured parties. Continuation Statements need to be timely filed or the EFS lapses and you may lose priority over secured assets.

Consequences of EFS expiration and how to avoid them

When an Effective Financing Statement expires, it can have serious implications for secured parties. If the EFS lapses, its security interest may become unperfected and lose priority to other creditors or buyers of farm products. This may substantially impair the secured parties position, and in some cases completely extinguish their interest on the collateral.

In order to prevent these types of ramifications, parties of the secured variety need robust systems in place tracking their EFS filings. Automated reminders—as early as 6 months before expiration dates—can ensure continuation statements are filed on-time. Similarly, you should periodically review your open EFS filings to ensure that their information is correct (and update any changes as necessary). With a bit of vigilance and proactivity on the part of secured parties, they can keep their EFS up in good order to protect interests in those farm products specified.

Can an Effective Financing Statement be filed electronically?

Electronic filing options for EFS

More and more EFS (Electronic Filing System) entities are offering secure parties to galaxy interface for you the file your EFS. In accordance with the broader trend of expediting debt financing via digital commerce, many states have developed online portals or E-Systems which allows applicants to submit their EFS filings electronically. These electronic platforms frequently have person-friendly interfaces that walk filers through the submission process resulting in all necessary information being covered within the filing of financing statements with[in] any difficulties.

With the electronic filing options, secured parties can avail features such as obtaining submission confirmation in real-time, viewing their EFS immediately indexed and being able to search & retrieve any filed statements easily. Additionally, certain systems may include linkage to an existing database management software for better tracking of multiple EFS filings. While electronic filing is more common now, availability and procedures differ by jurisdiction.

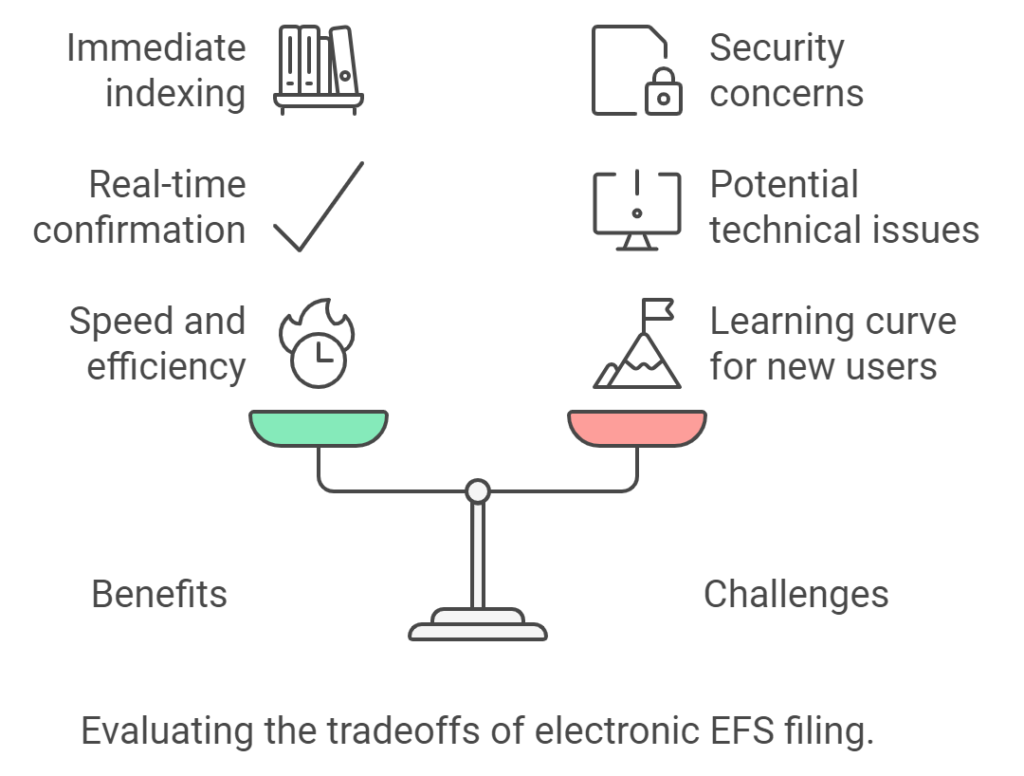

Benefits and challenges of electronic EFS filing

Electronic filing of Effective Financing Statements confers some advantages upon secured parties. Your filing will be received and confirmed almost instantly once your submission has been fully processed, one of the greatest benefits being how quick it can take place. Especially useful in the race to perfect a security interest. Also, electronic filing usually means, few errors are made — most systems have validation checks to confirm that all necessary fields have been completed properly.

However, there are challenges to electronic EFS filling. For secured parties, the shift from paper to electronic processes could have a learning curve. And then there is always the possibility of any technical difficulties or issues with systems that can halt filing capabilities for a short period. We also can’t reasonably ask filers to take additional unnecessary risks with the transmission of their sensitive information over a different, and potentially less secure platform, and there are pallets full of other practical solutions that all this creative brilliance gets incoherently swept under. Nevertheless, the efficiency gains for most secured parties generally override these negatives.

State-specific requirements for electronic EFS submission

Though the processing of Effective Financing Statements through electronic filing is spreading, keep in mind that requirements can differ widely from state to state. One jurisdiction may require electronic filing on all EFS submissions, while another offers it as an option to traditional paper-based methods. It is the responsibility of a secured party to become aware of any additional requirements in their particular jurisdictions so they can ensure proper compliance with those regulations.

Special requirements to submit an electronic EFS based on State are performance category file formats for attachments, processing methods of e-signatures or other id tools. In certain states, secured parties must register for an account or otherwise obtain specific credentials to gain access to their electronic filing system. Filing Fees and Payments for Electronic Filings — Fee structures and payment methods laws/courts can vary per jurisdictions. For very specific guidance regarding the electronic EFS submission requirements in each state, be sure to visit the website of your state’s Secretary of State office or central filing system.

How does an Effective Financing Statement protect secured parties?

Legal protections offered by a properly filed EFS

The filing of an Effective Financing Statement (EFS) is essential for parties who have a security interest in farm products. The main reward is fixing perfection and priority of the security interest in those described agricultural assets. Perfection is necessary to ensure that the secured party’s claim can be enforced against third parties, such as other creditors or buyers of farm products who might have a competing purchase-money security interest.

It is a public notice (though it will give you no priority over unperfected parties), that there exists the security interest. This notice serves a key purpose in the farm product context, as it prevents buyers from asserting that they acquired the goods unencumbered by any security interest. A secured party may preserve its rights by filing an EFS, even if the debtor sells collateralized farm products without consent. Farm credit is necessary for all financial undertakings in agriculture and this protection is some insurance that a lender will get his or her money back.

| Protection | Description |

| Perfection of Security Interest | Establishes priority against third parties |

| Public Notice | Alerts interested parties to the security interest |

| Maintenance of Rights | Protects secured party even if products are sold |

| Specific Collateral Identification | Enables precise definition of security interest |

| Centralized Tracking | Facilitates efficient management of security interests |

EFS role in securing interests in farm products

Central to the protection of farm product interests is the Effective Financing Statement which, by using a specialized mechanism that responds directly to problems particular in agricultural lending, has long been an essential device. The EFS form differs from a regular UCC financing statement in that it asks for more specific information about the farm products, allowing lenders to better identify their collateral. Where specific collateral is stated, claims are minimized and the security interest delineated.

Second, the EFS system — especially for states with central filing systems— makes it easier to follow whose security interests in farm products. It helps because such an approach is centralized and if anyone wants to search whatever agricultural assets exist elsewhere with the liens then that would be easy. This system benefits secured parties, as it will larger increase the transparency and priority of their security interests in farm products used as collateral for a debtor’s obligations while minimizing such party risks being subject to unanticipated violations of its rights therein.

Limitations of EFS protection and additional security measures

Although an Effective Financing Statement offers excellent protection to secured parties, it must be understood that the tool has its limitations. The EFS is used almost exclusively as a notice system and does not create an attachable security interest in itself. It is still necessary for secured parties to have a security agreement in place with debtor Moreover, the value of an EFS depends on how promptly and accurately continuation statements are filed to keep it in place.

Because of these limitations, UCC secured parties often take additional security measures to protect their farm product interest. For example, a creditor may ask for monitoring reports on the debtor’s operations or periodic verification of inventory or growing crops and pre-approve all downstream purchasers of farm products as parties to direct payment agreements with the secured party.

While this program can secure a substantial amount of any unsecured exposure, additional collateral and/or personal guarantees may be required from lenders to ensure the EFS provides appropriately protected lending. When secured parties create a more holistic approach to their security in agricultural financing activities, by filing an EFS properly and then completing these other steps together with it.

What are the consequences of failing to file an Effective Financing Statement correctly?

Legal implications of incomplete or inaccurate EFS filing

But getting that Uniform Commercial Code (UCC) filing wrong — more specifically, an Effective Financing Statement (EFS) error in a UCC document? A security interest perfected by an incomplete or inaccurate EFS may be rendered ineffective so as to lose its perfection and priority. This could subject the secured party to claims from other creditors or buyers of the farm products. In some instances, the courts will determine that an EFS which was not filed correctly does not give notice and thus a lien is unperfected.

In bankruptcy situations, the repercussions of a failed EFS can be especially catastrophic. If the debtor files for bankruptcy, an unperfected security interest can be treated as subordinate to other creditors (including non-secured) or extinguished by the trustee in a bankruptcy. As a result, the secured party may be deemed an unsecured creditor and potentially receive only pennies on the dollar of its claim. This illustrates how crucial it is that all EFS filings are both complete and accurate due to the legal implications.

Potential loss of security interest in farm products

By not filing an Effective Financing Statement properly, one of the gravest implications would be exposing a security interest in farm products to jeopardy. Absent a timely and proper EFS, the security interest may fail to achieve priority against bankruptcy trustees or other creditors who have perfected their interests as required by state law. This is true, even if there would be a valid security agreement between the secured party and the debtor because EFS functions as public notice of the existence of that security interest.

It likewise provides that an EFS can become not effective with respect to sales of farm products if the buyers take free without a sense of duty regarding security intrigue. This is especially an issue in the raw ingredient arena where items are generally bought and sold often used for production.

By proving that an EFS was filed incorrectly and the buyer acted in good faith, a purchaser can potentially assert title to farm products free of any adverse security interest. Developing a security interest that meets this test is important because, if the secured party loses out to some other claimant (like an insolvency administrator), it will have no recourse against the sold collateral itself and therefore be seriously out of pocket.

Remedies for correcting EFS filing errors

Even so, the fallout from an EFS filing error can be severe, but there is a way out to correct such errors by simply filing a continuation statement within the prescribed time. If any secured party discovers an error, the immediate course of action should be to file an amendment to the EFS. It needs to clarify this amendment as the original filing and provide all archival information. Should the errors be significant or affect important items such as the name of a debtor, there may be circumstances where it is actually necessary to file an entirely new EFS.

It is worth mentioning that while corrections are possible, they do not always bring about the priority date of origin. The severity of the correction can vary and may be limited by things like what exactly had gone wrong, as well as whatever rules apply to EFS amendments in that particular jurisdiction.

Where the length of time that has passed is substantial, or where third parties have acted on false information to their detriment, it may be necessary for a secured party (using legal counsel) to investigate possible alternative remedies, including possibly negotiating with these other affected persons. The other errors are more indicative of subtle gaps in the EFS program, but proactive monitoring and regular audits of your EFS filings can help correct them before they do any damage.

READ MORE ARTICLES HERE: HTTPS://RAASHQ.COM/

FAQ

Q: What Constitutes an Effective Financing Statement [EFS] under LII § 1631(c)(4)?

A: To be a valid UCC, this information must contain specifics regarding the debtor secured party and collateral in accordance with § 1631(c)(4) of the Legal Information Institute (LII), as required by the Food Security Act.

Q: In what form may a secured party file its financing statement?

A: The properly office of the Secretary states, usually that where debtor located. Appellate courts that did consider the question found little guidance from UCC jurisprudence but such appellate court decisions are becoming scarce in light of electronic filing options offered by many states tremendously simplifying processes for secured creditors. The filing must be in compliance with the state regulations and include crucial information required by UCC.

Q: How Does an Effective Financing Statement Contain Information?

A: A financing statement is effective if it includes the name and address of the secured party, discloses sufficiently that a debtor may be introduced to complete an agreement by showing from web-based proposals obtained through farmerveteran.org much more, arguably how-to information on fulfilling obligations for farm products as collateral. It might also need the debtor’s unique id e.g. SSN, Tax ID etc.

Q: Will the debtor be filing an EFS or providing it to purchasers directly?

A: No, EFS or to be sent directly to buyers are not available for a debtor. The creditor files the EFS with a specific Secretary of State’s office. When the buyer eventually gets approximate notice of the security interest limit through either a search at this particular state’s UCC generator research selected or directly from some sort of secured party.

Q: How long is a financing statement valid and in effect for?

A: It depends on the state, but it’s usually good until five years after you first file. A secured party must file a continuation statement before the lapse of an initial financing or face losing perfection in its security interest.

Q: What if the financing statement is materially misleading?

A: A financing statement may be seriously misleading if it contains an error and, in that event, ineffective. This would have the effect of preventing perfecting by that secured party. However, if the errors do not make it impossible to find a filing by searching records according to the debtor’s correct name — which would be information that is seriously misleading — then only minor inaccuracies generally are acceptable without invalidity.

Q: How the Minnesota Secretary of State processes financing statements for filing?

A: Financing statements can be filed electronically or by mail, with the Minnesota Secretary of State office. In essence, they provide the forms and prove guidelines for proper filing including but not limited to: name of Debtor(s), secured party address information (or such name details) with collateral description. The office also maintains a publicly accessible database of all UCC filings.

Q: What is the effect of a debtor’s signature on a financing statement?

A: The debtor or someone authenticated by the debtor in an electronic manner must sign a financing statement for it to be enforceable. It constitutes permission to lodge and the debtor’s acceptance of a pledge. This could be substituted for a secure authentication process in electronic filing systems.