Today, with our busy lives and having to contend not just with daily expenses but also monthly overheads like rent payment; manning finances can be quite tough. Flexible finance has a few novel solutions to help those wishing to convert rent into smaller, more reasonable payments. Specifically, certain flexible finance loans, like title and payday loans provided by various companies throughout Canada such as Easy Financial stores can help you create a positive rent payment history while putting you on the path to financial stability.

What are Flexible Finance Loans and How Do They Work?

Understanding the Concept of Flexible Finance

An innovative approach to loans, flexible finance is designed to give borrowers more flexibility when it comes to how they spend their money. Using this groundbreaking idea, people can pay an exorbitant price like rent in bits. Flexible finance loans give people this option, meaning that they can keep their finances under control and reduce the stress related to large lump-sum payments.

At the heart of flexible finance is the idea that lending as a process could feel more bespoke to the needs and circumstances of an individual in order to meet their specific requirements. This is an approach that acknowledges older lending models may not always reflect the financial reality for a lot of people, namely those who find they cannot predict when sudden expenses or an irregular income will kick them into hardship. Designed to provide easier and less stressful financial management for a broader scope of people, these loans come with terms and repayments options that are more flexible than most.

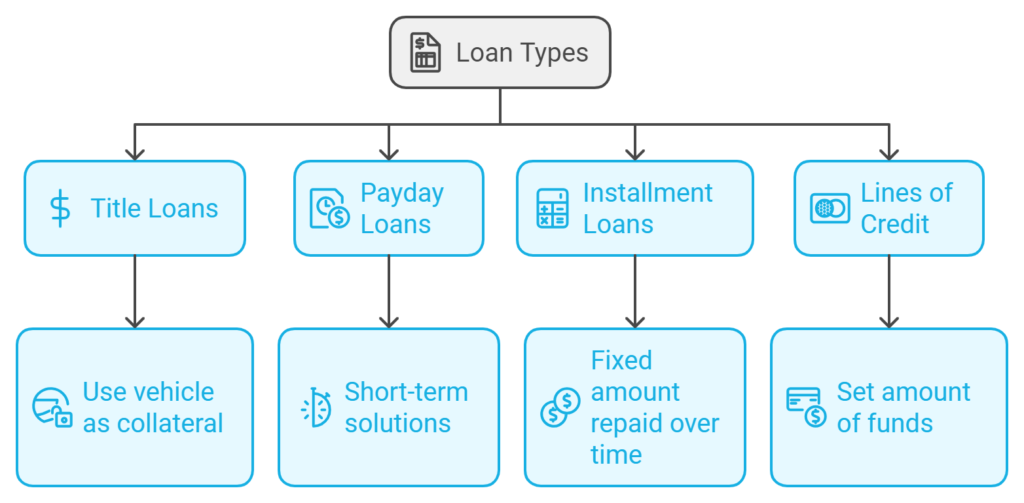

Types of Loans Offered: Title Loans, Payday Loans, and More

There are different kinds of loan these three availed including typical home loan, the line of credit or all in one loan. For example, title loans enable borrowers to place their car up for collateral which typically can lead to higher borrowing amounts. Meanwhile, payday loans are short-term cash solutions based on a specific amount of money that borrowers can collect until they repaid their next wage. They are just some of the flexible finance loans that can be offered to customers.

Flexible finance can include installment loans and lines of credit in addition to title loans and payday loans. A fixed amount is dispensed that can be paid back over time in predictable, periodic installment payments. Lines of credit, much like a credit card, allow borrowers to draw upon a set amount of funds as needed, essentially providing ongoing flexibility for many costs, including rent.

How to Use Flex App for Loan Applications

Flex App is a new mobile app that offers an easy-to-use platform to simplify the loan signing process for flexible finance products. A revolution in lending with the ability for users to apply for loans that also targeted rent payments in an easy and accessible format. Flex App simplifies what is often a complex and time-consuming process of obtaining financial assistance to help pay for rent bills, using technology.

In order to begin using the Flex App, borrowers are generally required to establish an account, complete a basic personal and financial profile, and select which loan product they wish to pursue. The app then walks users through the loan process — in some cases delivering immediate decisions on loans. The efficiency of this system ensures it is also a more open and accessible way for people to discuss their variety of ways they can make money flexible in relation to, among other solutions, how to turn rent into improved balance sheet payments.

Can Flexible Finance Help You Pay Rent on Time?

Breaking Down Your Rent into Smaller Payments

Flexible finance is a groundbreaking solution for pay rent now payment and enables you to divide your overall rent into more payable installments. This ground-breaking system for many people makes it difficult to pay a lot of money at once each month, especially for those who have irregular income or unexpected expenses. Flexible finance options — When renting, renters can match their rent payments with the day they get paid, which leads to decreased financial stress and better cash flow management overall.

We work with a flexible finance provider who sits between the tenant and landlord to carve up the rent. The flexible finance company pays the entire rent to the landlord on behalf of the tenant and in return, the tenant reimburses the capital provider with smaller, but more frequent payments. This arrangement also benefits tenants as it ensures they are able to keep paying their rent on time, and landlords benefit this allows them the peace of mind that means they receive the full amount of rent on time every month and a hassle-free income making the agreement mutually beneficial for both parties.

Benefits of Using Flexible Finance for Rent Payments

There are many advantages for tenants in using flexible finance to pay their rent. Most importantly, it is a way to guarantee that your rent gets paid on time — which is crucial to get into good standing with landlords and avoid any late fees or penalties. Consistency — This can also go on to make a positive rent payment history which could certainly help ease up the bottleneck when applying for rentals in future or sometimes mortgage too.

By fragmenting the full rent into smaller, bite-sized sums, tenants can also start to get even less shit together by making sure their main living costs are more in unison with their pattern of incoming money over the month, easing money stress and streamlining budgeting.

As well as being useful for trips, it can also soften the blow of a financial shock with its flexible hire-purchase options. For example, if a renter has a short-term cash flow challenge the ability to time-delay their rent payment may prevent default. Additional perks of certain flexible finance programs include the option to report your rent payments to credit bureaus — giving you an opportunity to build your credit score in a couple of months. This extra benefit, in turn, creates long-run financial health and future borrowing ability for an individual.

| Benefit | Description |

| On-time Payments | Helps ensure rent is paid on schedule |

| Positive Rent History | Contributes to building a good rental record |

| Stress Reduction | Aligns rent obligations with income cycles |

| Financial Buffer | Provides protection against unexpected challenges |

| Credit Building | Potential for rent payments to be reported to credit bureaus |

How Does Flexible Rent Impact Your Credit History?

Building a Positive Rent Payment History

Having a flexible rent payment can have a huge effect on your credit history as this will help you accommodate a positive rent payment record. Regular, on-time payments through a convenient financing service indicate financial responsibility and are an indicator of reliability. Having those payments each month helps maintain a robust credit profile. Fortunately, flexible finance institutions have started to identify that rent plays a key role in someone’s financial profile and have gone some way to providing systems in which these payments are correctly tagged and recorded.

When you use flexible finance options to rent, you are building a new history of all that money for subsidies. This background can be especially useful for people who do not have much credit history in traditional forms such as credit cards or loans, keeping a clean rent payment record is evidence of your financial peace and can help you when applying for loans, credit cards or mortgage awards. Keep in mind, specific flexible finance programs vary and some may or may not report to credit bureaus.

| Aspect | Impact |

| Payment Record | Consistent payments demonstrate financial responsibility |

| Credit Building | Can help establish credit history for those with limited credit |

| Credit Reporting | Some services report rent payments to credit bureaus |

| Credit Score | Timely payments can contribute to improving credit scores |

Reporting Rent Payments to Credit Bureaus

A key benefit of this style of finance for rent is that the payments could be evidenced to credit bureaus. Credit reports do not include rent payments as a rule, which has traditionally meant that although many tenants pay their rent on time every month, they were never given credit for these consistent rental payments. The good news is that more rent payments are beginning to be reported thanks to flexible finance companies partnering with credit bureaus. This reporting may boost your credit score significantly if you are diligent in making payments according to schedule and you have little history.

Many, many years ago you could NOT report rent payments to the credit bureaus and they would not put it on your official credit report as a part of your rent payment history and information. This means one on-time payment can help you continue to build credit. Through a unique process that considers the way younger people and credit repair types use balances; it provides an incredibly important tool for improving overall financial profile.

You should also check with your flexible finance lender if they report to any of the credit bureaus, and which ones. This can also give you some insight as to how your rent payments though flexible finance are improving or hurting 3big picture financial image and credit score.

What Are the Recommended Reviews for Flexible Finance?

Customer Experiences with Flexible Finance Loans

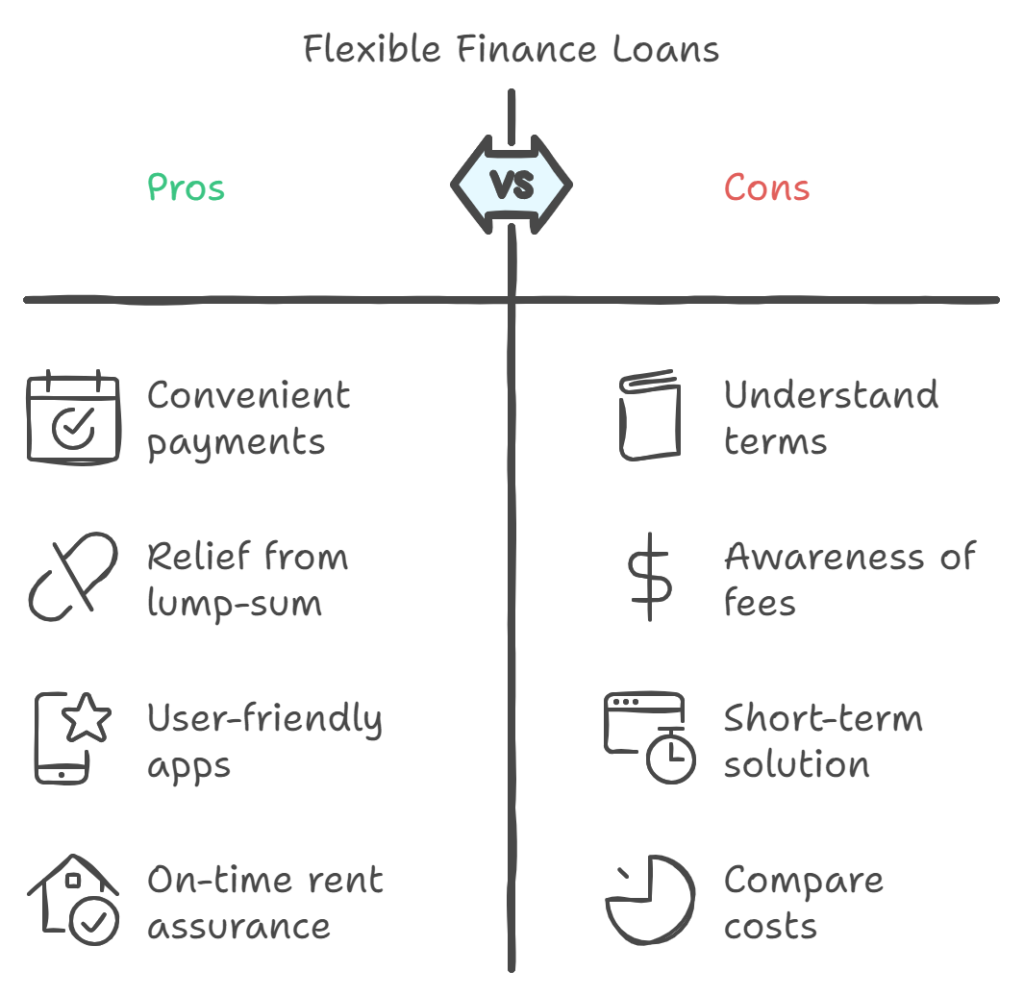

For instance, customer reviews of flexible finance loans typically point out the convenience and relief these options bring regarding handy cash solutions to manage your rent payments better. A number of users say that paying for the location monthly subscription is good thing as it gives them the flexibility to split their rent over a period of time, easily lowering the barrier which they find valuable.

Those with bad money flow (e.g. irregular or tight budgets) won’t trust this feature especially much, but everyone benefits from being reminded in very clear ways what they’ve been and where. The user-friendly interfaces and simple processes are kept on being praised in reviews, most of which say that flex apps make applying for a loan and paying it back effortless. Users also frequently attest to the comfort of not having to worry about making rent during a month when funds are less secure.

That said, some reviews do warn that flexible finance loans do require a good understanding of the terms and conditions. The one caveat is that lurkers start to rails against the interest rates and fees attached with these offerings. Most positive reviews are from people who have used flexible finance responsibly as a short-term solution or to restart their budget.

Reputable flexible finance companies tend to be transparent and enjoy a rave review from reviewers, working with customers for manageable payment plans. Most customers write positive comments in their reviews, more so when flexible finance has been used correctly i.e. as a cash flow tool as well as ensure rent payments are done on time.

Comparing Flexible Finance to Other Lending Options

Finally, when matched up to other types of loans, many reviewers feel that flexible finance offers a more suited response for rent payments. Unlike the more common but, typically, short-term and high-interest payday loans or title loans, flexible finance solutions for rent are generally characterized with a focus on longer-term solvency.

Reviewers often comment that flexi rent-to-own allows for more flexibility than getting a lump sum loan. Moreover, the ability for these payments to help build credit (and not damage it) is considered one of the major pluses compared to other loans — which usually do affect your credit history.

However, comparisons also show flexible finance is not always the cheapest option overall. This is one of the reasons some reviewers say that while there’s no doubt about how convenient flexible finance services like this are, they can also come with high costs. This is typically weighed against avoiding late rent fees and helping potentially positive effect credit scores.

Most users realize that while it may be cheaper, the real value in flexible finance comes in its limited range to rent payment and peace of mind. The main message from reviews is that anyone considering this type of extended and artificially flexible finance should also take a good look at the total cost before going through with it, otherwise seek other finance options like personal loans or proper credit cards over more opportune and convenient short-term options.

| Aspect | Flexible Finance | Traditional Loans |

| Purpose | Tailored for rent payments | General purpose |

| Repayment Terms | More flexible, spread out | Often shorter, fixed terms |

| Credit Building | Potential to build credit through rent | Varies by loan type |

| Interest Rates | Can be lower for rent-specific options | Often higher, especially for short-term loans |

| Convenience | Designed for recurring rent payments | May require new application for each loan |

How Can Flexible Finance Improve Your Cash Flow?

Managing Irregular Income with Flexible Payments

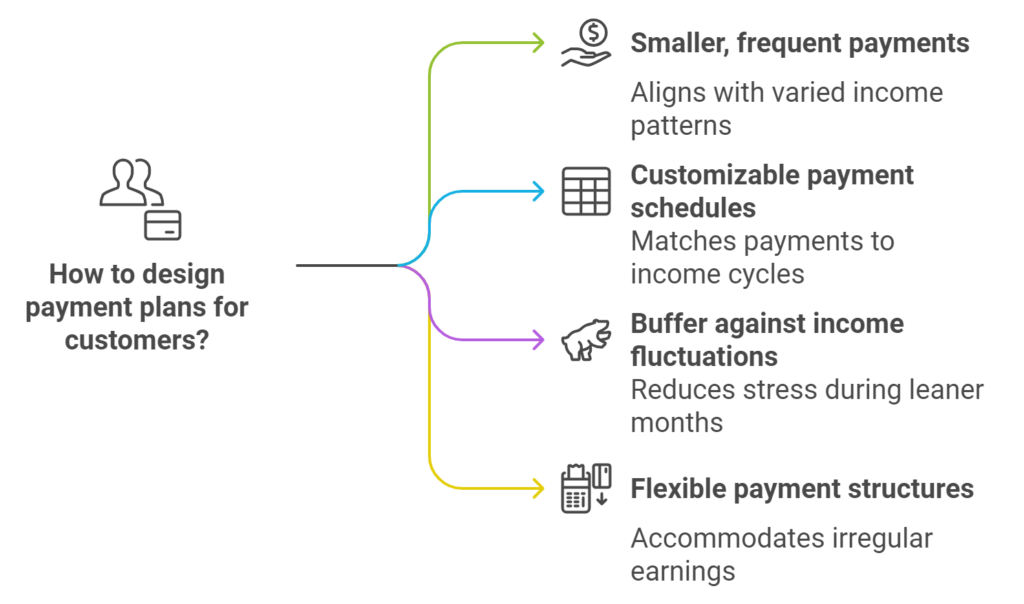

For those of us whose income can be slightly erratic, flexible finance provides the perfect way to manage cash flow — especially when it comes down to paying your rent. Flexible finance breaks down the total rent payable into smaller more frequent payments, enabling rent obligations to align with varied income patterns of renters. It works out better via this especially when people work freelancers and part-time or seasonal employees. With flex apps, users have the capability to schedule payments around your pay frequency in order to make sure that rent is consistently paid on time, regardless of monthly income changes.

Additionally, it acts as a safeguard against fluctuations in the availability of income. The flexible payment model can help users tide over leaner months by allowing them to balance their rent outgo during these times without a financial strain. This flexibility also eliminates the stress that comes with having to pay 3–4 months of rent at one time and inherently facilitates better financial planning. The ability to offer this type of flexibility according to the cadence of unpredictable income streams helps keep people in (affordable) homes, while ensuring their financial lives are managed more effectively without crippling them.

Avoiding Late Fees and Penalties

One of the primary advantages of a flexible financial plan is that it can help you stay out of debt when it comes to your rent. Real estate payments (rent): These are billed on specific dates and billing structure, with normal repercussions in terms of splitting the bill, discount due to prompt payment and late fees outside a certain buffer-zone. Flexible finance options, however, allow tenants to split their rent into parts and pay in small installments during the month. The approach also lowers the likelihood that tenants will forget to pay one huge bill on an arbitrary date and incur extensive late fees and potential negative hits to their credit history at once.

And by paying these smaller, adjustable installments every pay cycle, tenants can also keep in good standing with their landlords. Most flexible finance programs on the market see to it that landlords get all their rent in full and on time—even if the tenant paid for it in installments. This, not only spares the tenant from penalties but also saves an image of loyalty in rent. Managing cash flows and avoiding late fees, and the penalties can constitute significant savings which over time will enhance your financial health allowing you to better apportion your resources and may result in a boost to your standing with credit bureau.

What Should You Ask the Community About Flexible Finance?

Real User Experiences and Tips

As much as flexible finance options, one should rather head over to the community of REAL users. Talking to people who have been there and done it can provide you with practical tips and real-life guidance when implementing activities undertaken by flexi-rent finance brokers. Questions could be how do they juggle their flexible rent payments on the flex app, what tricks are utilized to ensure they make every payment date and how has flexible finance influenced budgeting and financial planning? It can also be very helpful to ask them what obstacles they have come across and how they overcame those.

Strategies for Hyper Mint itself are by the community and may benefit from a specific type of flexible finance advice as well. You can inquire, for example, about what the process is like in terms of creating good rental histories or ask if anything has changed on their end by way of a credit score yet. For example, sharing pointers on how to correctly negotiate with landlords as it pertains to utilizing flex finance for rent paid by users. A look at real-world experiences can show how flexible finance stacks up when compared to other ways of addressing rent payments, and give a more complete picture of its pros and cons in practice.

Common Concerns and Solutions

When it comes to such things as flexible finance options, it is not unusual that those who might benefit from them can have worries and queries. To solve these problems, it can be answered by engaging with the community as well. Some of these questions are usually regarding how trustworthy the flexible finance services can be, if this affects credit scores and what is the overall cost in relation to traditional rent payment methods. It is certainly useful to ask how community members have addressed these topics, and which strategies work for them.

Important Topic to be covered with the community: It is also a worthwhile topic to explore as the chances of running out of money are very high when flexible finance for rent is in use, how does one handle sudden unanticipated financial problems? Examples of some of these questions are, are the services flexible when following change in due dates that you may experience or changes to your inflow.

People may also share customer support experiences by finance companies offering flexible hours as well as how on the ball they are when things go wrong. In explaining some of the fears and ways to alleviate or negate them, possible users can get a better sense of what it is like to pay rent through flexible finance, as well as how to get the most out of these services.

How Has Flexible Finance Updated Their Services?

New Features and Improvements

Flexible finance services have rolled out several new features and improvements for a better user experience and money management capabilities as of October 2024. Notable among a bevy of improvements is the inclusion of cutting-edge machine learning algorithms in our flex apps, which power custom payment plans, adapting to users’ unique income cycle and spending patterns.

Create or Edit Annotation This smart tech allows users to time their rent payments exactly to when they get their cash, significantly reducing the chance of missing a payment. Furthermore, a lot of pay-as-you-live providers have introduced an auto-save element to their services for its users where they can put aside small amounts with each rent payment and save them towards other financial endeavors.

The most important improvement is that Tallie received a significant upgrade in its reporting features. Flexible finance companies, too, have deepened partnerships with credit bureaus to ensure that rent payments are more systematically reported and full rent charged to boost credit scores.

In addition, certain providers have initiated real-time credit score monitoring directly in their applications to illustrate how flexible rent payments impact the profile of a user. More recently, there has been a push in educational resources that exist on these platforms that help provide members with greater financial literacy tools and encourage not just healthy rent payment habits, but financial awareness as well.

| Feature | Description |

| AI-powered payment scheduling | Personalized schedules based on income patterns |

| Automated savings features | Set aside small amounts with each rent payment |

| Enhanced credit reporting | Stronger partnerships with credit bureaus |

| Real-time credit score tracking | Monitor impact of rent payments on credit |

| Simplified fee structures | More transparent and easy-to-understand terms |

| Safety net features | Options like one-time payment deferrals without penalties |

| Extended payment periods | Longer-term options for spreading rent payments |

Changes in Loan Terms and Conditions

As of October 2024, the flexible finance sector has seen major shifts towards an open and clear user-first approach in loan terms and conditions. Most providers have also simplified how they price, stripping away complex pricing to simple consistent pricing. It will require more transparency about the various costs that come with flexible rent payments, letting people users choose in a way that has heretofore been impossible. A few have even adopted pricing tiers that calculate cheaper rates for repeat, on-time users which provide discounts as an incentive to continue being a good customer.

Flexible finance companies have also responded by updating loan terms in response to a changing regulatory landscape and customer demand, such as improved ways to manage rent bills. This security blanket includes looser payment adjustment or extension policies since personal finances can unpredictably change. Some have implemented “safety net” offerings like one-time payment deferrals with no penalty when users experience a financial hiccup. There has also been a rise in longer-range flexible finance deals, enabling renters to stagger their payments over the long term — an especially good thing for people who earn seasonally and need time to pay off their rent each year.

READ MORE ARTICLES HERE: HTTPS://RAASHQ.COM/

FAQ

Q: What types of loans does Flexible Finance offer?

A: Flexible Finance offers a range of loan types include unsecured personal loans, secured lines of credit and title loans. Rent — Earn something for your rent, and build credit while positively impacting us. Our loans are built with you in mind to help meet your financial needs in life.

Q: How to pay rent using flexible finance?

A: You can pay your rent with Flexible Finance loans or lines of credit. Seamless rent pays options, even to the point of splitting payments with roommates if it helps. Plus, it allows rent payments to be reported by one or more national credit bureaus, enabling renters to create their credit history.

Q: Is Flexible Finance a bank?

A: No, Flexible Finance is not bank. Loan services are only provided by our partner Blue Ridge Bank or Lead Bank, N.A. a financial technology company. These banking partners provide the loan proceeds and lines of credit, and Flexible Finance Servicing performs the servicing and collection activities.

Q: Can I get a credit line with Flexible Finance?

A: Yes, we report your payment history to at least one of the national credit bureaus. You can build that credit history through paying off your loan or line of credit on time. This is perfect for renters who are trying to build credit by paying rent on a regular basis.

Q: What makes Flexible Finance stand out among the rest of lenders?

A: As a family operated business, this helps lend an understanding hand. We blend cutting-edge financial technology with human customer service, offering options to make life easier and leave renters both more secure by helping them build credit.

Q: How the loan disbursement process operates?

A: Upon approval, Flexible Finance will disburse loan proceeds to you or in some cases your landlord for rent. The process will depend in part on the type of loan you have and personal circumstances.

Q: When is my 1st payment due, and how will I know?

A: Usually, the pay day is a selected date equivalent with your own compensation. Date In adherence of that, we make a repayment as simple and flexible to you and your financial circumstance.

Q: Are there any Flexible Finance Reviews?

A: Yes, customer reviews and ratings for Flexible Finance can be found on multiple sources, including Yelp. Read our customer stories to find out what other customers think about our car loans and services before making your decision.

Q: If I am having difficulty with a payment, what can I do?

A: We know that things can change often in the world of finances, which is why our staff at Flexible Finance are always happy to help keep your wheels turning by working with you on a solution that suits your requirements.