With technology everywhere, it is essential to learn FintechZoom BA stock analysis if investors want to make well-informed decisions in today’s aerospace sector. This wide-ranging exploration looks back on how Boeing stock traded, what the market landscape looked like, and what lies ahead for investors observing the price of Boeing in 2024 and beyond. Through the following analysis by FintechZoom and considering other market sentiment, we hope to have a clarity of information about Boeing’s financial performance and growth prospects in this volatile time for both company operations.

What is FintechZoom and How Does It Analyze Boeing Stock?

Overview of FintechZoom Stock Analysis Platform

FintechZoom gives traders a new stock analysis platform providing them with better insights in the market including the aerospace giant Boeing. This platform uses sophisticated algorithms and data analytics to analyze massive financial data, market trends, economic indicators. Using these complex tools, FintechZoom provides detailed stock chart analyses to assist investors. Its easy-to-use interface provides real-time stock news, historical stock data, and expert analysis that makes it a great tool for both newbie and professional investors who want to understand Boeings overall performance.

FintechZoom has the honor of focusing on accuracy and providing accurate information in a sea of financial analysis. This is why the platform’s team of expert analysts examines market conditions, geopolitical factors, news that can affect specific industries on a daily basis – keeping their Boeing stock analysis fresh and accurate. This included an evaluation of Boeing’s market position as well as a quantitative analysis of its financials, covering all three elements crucial to a comprehensive investment insight on the company. Through a mix of quantitative information and qualitative insights, FintechZoom allows buyers to do higher funding by diving deep into exact dynamics looming in Boeings inventory. in addition to within the aerospace sector normally.

FintechZoom Approach to Analyzing Boeing (BA) Stock

When looking at the fundamentals of instances with a view to invest in long-term, FintechZoom momentum score primarily analyzes: (1) trends and cyclicality in the context/macro of Boeing (BA) stock market fundamentals; (2) entry price as an indicator of safety or riskiness in Boeing (BA) stock investment; (3) risk-adjusted performance based on known vs. estimated returns over time — including future main principal growth return from Boeing, earnings quality by rental income exposure as well as expected impact though macro factors like GDP trends.

The platform thoroughly reviews Boeing financials, including revenue growth, margins and cash flow to determine the health of the company. Moreover, FintechZoom keeps a close eye on Boeing’s order backlog, delivery rates and production efficiency — important measures of the company’s performance in the aerospace market. FintechZoom uses these key metrics to evaluate how Boeing is likely positioned today and into the future.

In addition, FintechZoom takes into account Boeing valuation data and market trend analysis for example on broader economic developments that may produce long-term impact on aerospace. That platform tracks worldwide demand for air travel, fuel prices and potential shifts by regulators that could influence Boeing’s economic fortunes. Moreover, FintechZoom considers geopolitical concerns and international relations in respect of trade that could increase Boeing’s sales volumes and market share.

FintechZoom combines macro-sectioning insights with company-specific data to provide a complete picture of how Boeing’s stock is doing, and simplifies the aerospace investment landscape for investors. That holistic methodology allows FintechZoom to share with you are not only both winning & losing ideas, but also complete investment themes for those interested in Boeing stock.

Key Metrics Used in FintechZoom Boeing Stock Analysis

FintechZoom uses an extensive system to measure all key metrics of Boeing stock and evaluate its performance in the financial market. A P/E ratio is one of the first metrics that come to mind when thinking about Boeing’s valuation relative to its earnings. The platform also extensively evaluates Boeing’s revenue growth rate, profit margins, and return on equity (ROE) to gauge the company’s profitability and efficiency. Analysts at FintechZoom have been investigating Boeing’s debt-to-equity ratio and cash flow statements to determine how the company finances its future growth initiatives.

FintechZoom uses some non-traditional financial parameters, including measures of Boeing’s performance in the aerospace industry that are important for understanding. The platform keeps a close eye on Boeing’s aircraft delivery rates, order backlog, and the market share of both its commercial and defense business segments.

Above interest from this feature, FintechZoom also tracks Boeing R&D Spending and contract awards as well as its performance in key programs such as, 737 MAX recertification, New Airline Models, global market conditions. Through the combination of detailed metrics like these with more broad financial data, FintechZoom delivers a nuanced look at Boeing’s performance as a stock overall which should provide the insight and context necessary to make an informed investment around its place in aerospace.

| Metric | Description |

| Price-to-Earnings (P/E) Ratio | Assesses Boeing’s valuation relative to earnings |

| Revenue Growth Rate | Measures the company’s sales performance over time |

| Profit Margins | Indicates Boeing’s profitability and efficiency |

| Return on Equity (ROE) | Evaluates the company’s profitability in relation to shareholders’ equity |

| Debt-to-Equity Ratio | Assesses Boeing’s financial leverage and stability |

| Cash Flow Statements | Analyzes the company’s ability to generate and use cash |

| Aircraft Delivery Rates | Tracks Boeing’s production and delivery performance |

| Order Backlog | Indicates future revenue potential and market demand |

| Market Share | Measures Boeing’s competitive position in various segments |

| R&D Expenditures | Reflects the company’s investment in innovation and future growth |

How Has Boeing’s Stock Performed Recently According to FintechZoom?

Boeing’s Stock Price Trends and Fluctuations

As FintechZoom has noted, with all of this in mind, it’s no wonder that Boeing stock has been bouncing around over the last several months given Boeing’s struggles and general market conditions for aerospace stocks. Boeing’s stock has been surprising stable given the challenges facing the company, including delays in its recertification of the 737 MAX and the significant impact COVID-19 has had on air travel demand as well. Boeing’s stock price has shown bursts of volatility with severe drops being met by strong recoveries, as news related to aircraft orders and deliveries, as well as regulatory updates prompt stock movements, FintechZoom reports.

Boeing is the share FintechZoom According to in-depth stock analysis; it has been one of the most moved by the announcements about 737 MAX return to service and its efforts to improve production quality control. It makes the case for how progress in these sectors has generally pushed Boeing stock up; and by contrast, defeats or bad news have weighed down (BA) stock.

FintechZoom analysis also indicates that Boeing shares are correlated spectrally with more general economic indicators — how they behave relative to changes in interest rates, and to global trade tensions — which should have consequences beyond just the stock for the broader aerospace sector. FintechZoom explores daily trends in the stock market and business world, so its users are better able to separate the noise from reality.

Comparing Boeing’s Performance to Aerospace Industry Benchmarks

FintechZoom has an extensive analysis of the performance of Boeing shares, which compares in detail with important aerospace industry benchmarks to give investors critical insights on how the company’s strength corresponds. The platform analyzes Boeing results within key indices including the S&P 500 Aerospace & Defense Industry Index as well as the Dow Jones U.S. Aerospace & Defense Index. Have we reached the nadir for Boeing stock? According to FintechZoom data, Boeing has struggled as a unique case, but the stock held up better than others in the industry during positive news or when strategic initiatives took root.

Additionally, FintechZoom analyzes the financial metrics and operational performance of Boeing in comparison to its major competitors, such as Airbus in the aerospace and defense space. Market Share, Order Backlog and Revenue Growth Rates Are Just A Few Of the Key Indicators That Are Assessed by The Platform To provide You a Clearer Picture of Boeing’s Competitive Position.

This side-by-side comparison allows investors to identify Boeing’s weaknesses and strengths against industry standards. This comparison is essential for investors who are looking at Boeing as this will help to put Boeing’s stock performance into context with the wider aerospace group and identify opportunities and risks in which part of Boeing’s market share.

Impact of Recent Events on Boeing’s Stock Performance

Much of FintechZoom analysis of how Boeing (BA) has performed on the stock market over the years focuses on the firm’s recent history and how a string of events has altered its fortunes in commercial aerospace. The service goes on to painstakingly review the effect that a 737 MAX global ground and unground of the plane has had in Boeing’s stock price and with investors.

According to FintechZoom, these events caused massive back-and-forth in the shares of Boeing: Ugly tumbles after bad news and strong rebounds whenever the company appeared to make some progress with safety or regulatory concerns. The platform’s analysis also points to how Boeing’s attempts to build trust in its products and production methods towards have translated into a positive stock performance.

This stock analysis from FintechZoom goes even deeper into the impact of the COVID-19 pandemic has had on Boeing’s financial health and market position. In this video, the platform analyzes what impact reduced air travel demand and consequent airline fleet adjustments have on Boeing’s order book and delivery schedules.

According to FintechZoom, the pandemic first made Boeing’s stock price plummet, but Boeing has a large portfolio so revenue was not solely reliant on commercial sales. In examining those developments and their continued consequences, FintechZoom provides investors with a fuller picture of what has influenced the performance of Boeing stocks and insight into what could be shaping the future trends facing the aerospace industry.

What Are FintechZoom Projections for Boeing Stock in 2024?

FintechZoom Forecast for Boeing’s Financial Performance

FintechZoom forward-looking estimates for Boeing’s 2024 financial results derive from a detailed analysis of several factors that are expected to influence the aerospace market and the company itself. This underscores the idea that Boeing´s revenue growth is likely to recover slowly in the aftermath of COVID-19 pandemic as air travel demand picks up around the world. Boeing’s cost-cutting should begin to show through in profit margins, according to a forecast by FintechZoom. Boeing also plans to have defense and space provide a solid earnings base for the company going forward, offsetting commercial aircraft market weakness.

By SA Transcripts In its deep-dive analysis, FintechZoom sees Boeing’s order backlog and production rates as flash points for future financial performance. The platform anticipates that Boeing will pick up the pace with commercial deliveries of its top-selling models such as the 737 MAX, which should be incremental to revenue and cash flow. FintechZoom also factored Boeing’s continued increased spending in research and development into its outlook, particularly for sustainable aviation and advanced air mobility.

Though these are likely to weigh on Boeing’s short-term profitability, the company believes that it will help improve its competitive position and boost long-term growth. By offering this detailed financial forecast, FintechZoom provides investors with the information they need to make important investment decisions about Boeing stock for the remainder of this decade.

Potential Growth Drivers for Boeing Stock

FintechZoom analysis lists several growth drivers that may boost Boeing stock in 2024. The biggest thing mentioned is a recovery in hopes that global air travel demand will bounce back and spark commercial aircraft purchases, helping drive Boeing’s revenue higher. Importantly, the platform also highlights strong positioning in the defense sector from Boeing’s considerable book of military contracts and with potential new deal-flow in budding special areas of modern era defense technology also poised to be broadly accretive.

FintechZoom also highlights healthy Monaco Boeing’s structural moves to drive sustainable aviation growth, like making more fuel-efficient planes and investing in electrical ancillary hydrogen propulsion, as potential long-term drivers of top line leverage that could strengthen the company’s competitive position and lift shares.

Additionally, FintechZoom is taking Boeing’s restructuring efforts to increase productivity and lower costs into account in its forecasts. Here the platform sees these initiatives, as well the company’s emphasis on greater innovation and focus on product development, driving better profit margins and resulting in additional cash flow generation. Potential growth areas that FintechZoom has its eye on also exist in Boeing’s moves into other whitespace markets as well as teaming up with the right new entrants to our industry.

According to the platform analysis, if these strategies were implemented effectively, they bode well for investor confidence and could do great things for Boeing stock price. Since FintechZoom delivers a detailed analysis of those growth catalysts, traders gain a significant understanding into what those elements that might ship Boeing stock greater in 2024 and properly throughout the longer term.

| Growth Driver | Description |

| Global Air Travel Recovery | Expected increase in demand for commercial aircraft |

| Defense Sector Strength | Ongoing military contracts and new opportunities |

| Sustainable Aviation Initiatives | Development of fuel-efficient aircraft and alternative propulsion systems |

| Operational Efficiency Improvements | Cost reduction and streamlining efforts |

| Innovation and Product Development | Investment in new technologies and aircraft models |

| Market Expansion | Entry into new markets and partnerships with emerging players |

Risks and Challenges Facing Boeing’s Stock in 2024

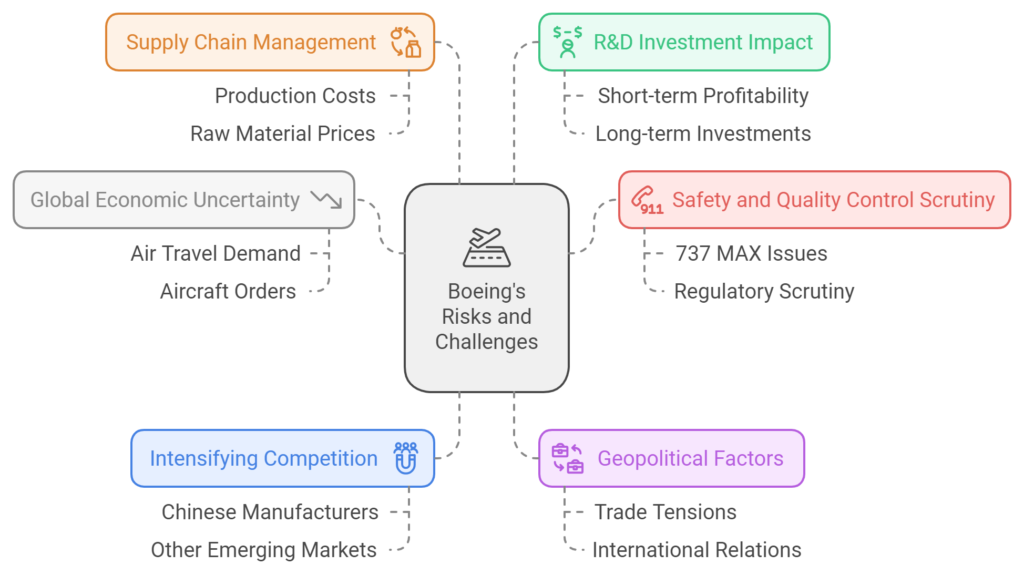

So, while FintechZoom analysis pinpoints two growth drivers for Boeing’s stock in 2024 — it also identifies an equal number of risks and challenges. Most notably, the existing variability of the global economy could once again be impacted by economic stress across a number of continents, and that could affect air travel demand and potentially have an impact on orders for aircraft as well as deliveries.

The plane also notes that Boeing continues to be the subject of ongoing criticism around safety and quality control in light of the earlier 737 MAX problems. If there is any hiccup or fresh concern in this space then it could hurt investor confidence significantly and that can have an adverse impact on the stock price performance. FintechZoom also notes that growing competition in the aerospace sector, especially from upstart rivals in China and elsewhere, could put pressure on Boeing’s share of market and margins.

FintechZoom and Bombardier ought to achieve this Balance Too — Your menace evaluation of Boeing stock 2024 moreover takes under consideration the geopolitical factors. Potential trade tensions, changes in defense spending priorities, and shifts in the global order are identified by the platform as potential risks to Boeing’s prospects worldwide. Essentially, FintechZoom underscores Boeing’s difficulties with supply chain management and production costs where inflationary pressures may soon play a factor in raw material pricing.

The platform also points out that Boeing is advancing large expenditures in R&D, which it says are critical to underpin long-term growth, but warns the group’s short-term earnings and cash flow will be impacted as a result. FintechZoom offers investors the most comprehensive view of stock performance in 2024 from opportunities to risks.

How Does Boeing’s Market Position Affect Its Stock Outlook?

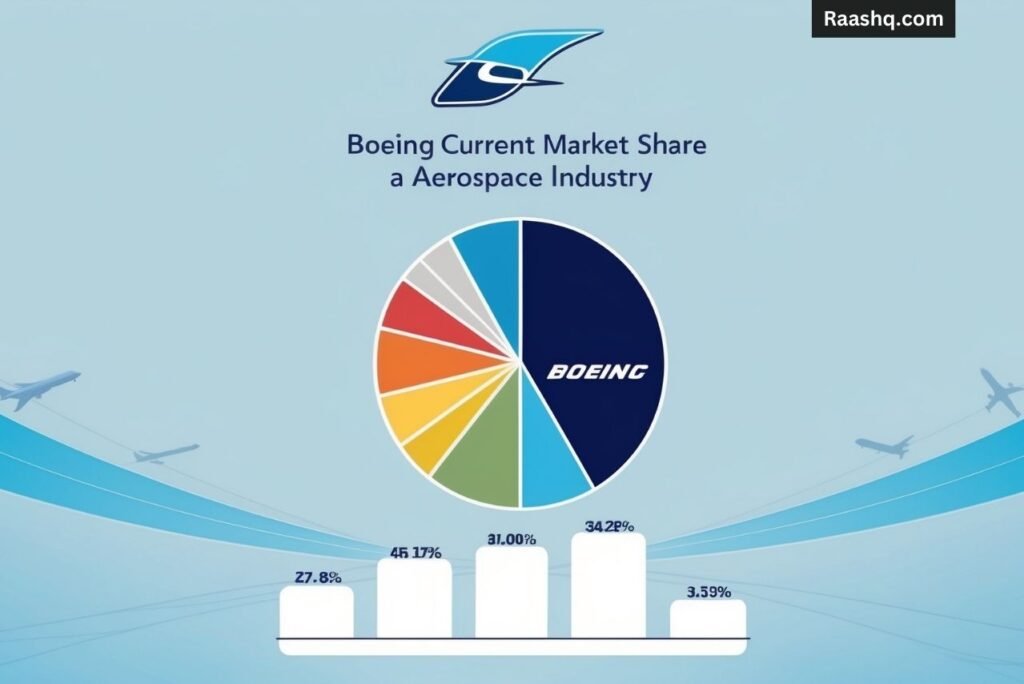

Boeing’s Current Market Share in the Aerospace Industry

According to FintechZoom market analysis of Boeing, the company has a well-established place in the aerospace industry across the globe. Boeing is still one of the world’s top producers of commercial jetliners, though Airbus has cut deeply into its business. Boeing’s market share has been on a roller coaster ride over the last several years amidst the global grounding — and eventual recertification — of its 737 MAX family, as well as the obstacles presented by the ongoing COVID-19 pandemic.

Nonetheless, the platform highlights Boeing’s breadth of offerings — which include the company’s wide deployment in defense and space sectors as well — has allowed it prop up its overall market position.

FintechZoom takes an in-depth look at what has actually happened to the aerospace giant’s market share — from narrow-body and wide body commercial jets to various military and space products — overall. Despite increased competition in select areas, Boeing has maintained leadership in several sectors, highlighted by its presence in the wide-body commercial aircraft market and on certain defense programs.

Innovation and the capability to shift as per modify in market demand will be key that sets Boeing as highlighted by FintechZoom insights above, apart from others, for its current market share and gradual increase. This assessment of Boeing’s state in the market is essential for investors to understand a company’s competitive advantage and disadvantages as well how it affects its stock outlook for long-term growth within the aerospace industry.

Competitive Landscape and Its Impact on Boeing Stock

A more detailed look at the banks could yield wider conclusions, but similar to FintechZoom examination of Boeing’s stock outlook, this broad analysis underscores the competition in aerospace. Airbus is referred to as Boeing’s arch-rival in the commercial aircraft space by the platform and points out that how this rivalry plays out between the two titans has a huge bearing on market dynamics and investor sentiments.

As the data from FintechZoom shows, changes in Boeing’s market share relative to Airbus based on various factors including new product offerings, pricing strategies and ability to deliver orders can directly impact the company’s stock performance. The platform likewise drives attention to new players, particularly out of China and Russia as potential disruptors that could impact the long-term tenure market position of Boeing (BA), and by extension its valuation multiples.

Beyond the commercial aircraft analysis, FintechZoom wants into other areas where Boeing competes such as defense and space. The platform evaluates Boeing’s performance in military contracts and space exploration projects in comparison to companies like Lockheed Martin, Northrop Grumman, and SpaceX. Boeing can win huge defense contracts occasionally and booms in space tech innovation, all of which have enormous sway on investor sentiment and share-price performance, according to FintechZoom.

This information found on FintechZoom reveals a detailed picture of how Boeing began to compare with other companies, helping investors understand exactly what changes have been made to the stock (or any of its competitors) outlook. One of things that the platform’s insights point to is how vital it will be for Boeing to continue to manage its way through this competitive labyrinth and maintain its edge in technology to support any potential long-term growth and shareholder value.

Boeing’s Strategic Initiatives and Their Potential Stock Implications

Check out this analysis of the Boeing stock outlook FintechZoom to better understand its strategic initiatives that could affect investors going forward. The platform also dives into Boeing’s focus on increasing operational efficiency, driving costs down and increasing product standards in light of the fallout from its 737 MAX travails.

According to FintechZoom, these efforts are designed to reignite confidence in the platforms that Boeing manufactures as well as the safety standards required for their certification, which resoundingly addresses key investor concerns about the stock. About these, the platform spotlight on Boeing’s investments in next-gen aircraft technologies and sustainable aviation solutions as strategic moves with potential to bolster competitive position and drive long-term stock appreciation.

FintechZoom has further processed a full-scale report evaluating Boeing diversification strategies and stock implications for our subscribers. Taken together, the platform explores how Boeing’s rich experience of ramping up in new markets (like urban air mobility and autonomous systems) could unlock incremental revenue pools and accelerate its progress going forward. FintechZoom also looks at who Boeing is working with, and in the aerospace ecosystem, those partnerships can provide access to new innovations and expanded market opportunities.

With this comprehensive analysis of Boeing, FintechZoom provides investors with insights into what strategic moves the company has in store, and how they may affect stock performance. According to the platform analysis, there are several reasons why these strategies could drive superior financial results and therefore create shareholder value in the stock of Boeing that investors must be mindfulness of.

What Factors Should Investors Consider When Analyzing Boeing Stock?

Key Financial Metrics to Watch

FintechZoom deep dive analysis of Boeing stock highlights many important financial metrics you’ll want to keep an eye on. Revenue growth is a key metric the platform looks for here, honing in specifically on how well Boeing’s commercial aircraft unit rebounds and on the performance from its defense and space units.

Another key metric that the folks at FintechZoom pay careful attention to is profit margins, improvements in which can positively affect Boeing’s profitability. The platform also focuses on cash flow, the financial metric that shows how much cash Boeing can generate to fund operations, invest in research and development and possibly return value back to shareholders with dividends or stock buybacks.

FintechZoom also reports Boeing’s firm order backlog as a key indicator of future revenue and market demand. The platform highlights the importance of watching new orders and cancellations, as these can give a sense of how much confidence airline customers have in Boeing’s products. The capital intensity of the aerospace industry and importance of financial flexibility also show up when it comes to debt levels and liquidity ratios.

FintechZoom also urges investors to look at the research and development spending of a given company — in this case, Boeing — “as it can tell us that a firm is making all attempts not only to innovate but also seek growth.” FintechZoom Focusing on these key financial metrics provides investors with information to discern how well Boeing is positioned as a tool in its future potential performance.

Industry Trends and Their Impact on Boeing

FintechZoom take on Boeing stock includes a great deal of discussion about general industry trends and their influence on the company. An important point made by the platform is that this recovery has broader implications than just Boeing’s orders and deliveries in its commercial aircraft business. FintechZoom also takes a look at sustainable aviation trends, such as the drive for more fuel-efficient aircraft and development of alternative propulsion technologies. The platform indicates that Boeing’s ability in new aircraft and technologies is skills, very important to the competitive aerospace market where a stock value can be determined by those of niche.

Moreover, FintechZoom thorough analysis features defense spending and space trends as key issues underpinning Boeing’s well-diversified portfolio. These same changes, according to the platform, could also pose both opportunities and obstacles for Boeing, with global defense priorities shifting and a larger portion of space activities going commercial. Finally, FintechZoom takes a broader look at the trend of digitalization and automation in aircraft manufacturing and operations, hinting that Boeing has embraced such technologies could be a positive for your company towards more efficient operations and potentially higher competitiveness.

With such an in-depth examination of industry trends, FintechZoom equips investors with the knowledge to help them make better investments for Boeing future. The analysis on the platform points out that investors looking to make sense of Boeing stock can’t go without this insight, as it serves as a highly impactful driver for insights into where the company is headed.

Geopolitical Factors Affecting Boeing’s Stock Performance

The FintechZoom analysis on Boeing stock takes a deep look that how geopolitics can be make or break this company based on the performance and market valuation. The platform notes that Boeing’s fortunes can hinge significantly on international trade relations, such as those needed to secure orders and deliver aircraft to its largest market the United States and key markets abroad like China and Europe. Trade tensions or modifications in trade agreements may also expose Boeing to tariffs or restrictions that could impair its global market position, as outlined by FintechZoom.

In addition, they take a look at the broader consequences of diplomatic relations and even geopolitical tensions on defense contracts, which will play an outsize role among Boeing’s business portfolio. According to FintechZoom analysis, investors should keep an eye on these international trends as they can quickly change the landscape for Boeing in terms of its market potential and overall financial ramifications.

Additionally, the FintechZoom stock analysis also takes into account global air travel and defense spending trends within the wider geopolitical panorama. The site evaluates how regional conflicts, political instability or changes in global alliances can impact demand for commercial and military aircraft. Ultimately, FintechZoom also points out the potential challenge of shifting regulatory environments from country to country, underscoring that Boeing’s development & market access can be affected by differing product requirements with respect to safety standards, environmental regulations or certification processes.

With such a meaty analysis of the geopolitical landscape, FintechZoom is also giving investors a more holistic view of those outside forces that could influence Boeing’s stock. The point the platform is making here is that, these are very important geopolitical complexities to have a grasp of for investors considering Boeing stock (with independent reporting like this able to change more buying suits on how well company does around world).

How Does FintechZoom Analysis Compare to Other Market Sentiments?

Comparing FintechZoom Boeing Stock Analysis with Other Analysts

FintechZoom analysis of Boeing stock includes many information sources and various factors when creating their assessment. In particular, the platform looks at the stock prospects from the lenses of long-term developmental tendencies, and data such as technological growth that other analyses do not focus on. This is because FintechZoom often relies on Boeing’s innovation pipeline to forecast its future market stake, whereas other analysts mostly consider short-term financial metrics. This makes it possible for investors to evaluate the stock from the point of view of both current performance tendencies and extensive growth potentials, granting a more three-dimensional picture of Boeing’s stock.

At the same time, the analysis based on FintechZoom models generated by its combination with machine learning and data analytics may provide a less subjective perspective on the company’s performance. Historically, FintechZoom analysis outcomes are generated by both statistical patterns and expert opinions. Therefore, the balance of the overall subjectiveness of the analysis is similar to what is observed in other reputable analysts approximate, even though FintechZoom utilizes much more advanced technologies. When compared with the other analyses in the market, it is possible to detect unique insights or those common between the platforms provide investors with.

Investor Sentiment Towards Boeing Stock

I put quite an emphasis on investor sentiment in my analysis of Boeing stock with good reason. It uses sophisticated data analytics to measure the mood of the market using a range of indicators from social media trends and trading volumes, to activity in the options market. According to FintechZoom, investor sentiment on Boeing has been rather fickle over the years vacillating between optimism supported by the company’s ubiquity of brand and market position and concern ranging from 737 MAX problems to COVID-19 impact on the airline industry. The site points out that good news on aircraft orders, smooth test flights or favorable regulatory decisions typically cause spikes in optimism and a correspond increase in stock prices.

In addition, FintechZoom takes into account the views of different groups of investors, such as market makers, individual retail traders and long-term stockholders. The platform measures the response of each of these unique groups to Boeing’s financial results, strategic communications and industry news to provide a multi-dimensional analysis among all market participants. And the great part is that FintechZoom also includes analyst recommendations and target price changes as well as of all the other activities in its sentiment analysis.

FintechZoom allows readers to get access to a more comprehensive perspective of what is happening at Boeing through our research. This insight is especially helpful for investors looking to gauge potential short-term gains while still being able to analyze Boeing stock over the long term. The platform notes that while sentiment can promote near-term price movements, it should be used to supplement fundamental analysis when deciding how to invest.

Reconciling Different Perspectives on Boeing’s Stock Outlook

This is precisely where FintechZoom comes in, offering investors a balanced perspective through its thorough analysis of Boeing stock. Of course, that said, there will be wide differences of opinion among analysts, investors and industry experts about how Boeing will perform in the years ahead. By synthesizing these divergent views, FintechZoom is able to offer a more nuanced take on Boeing’s stock outlook, writing from both the bull and bear points of view.

The platform looks at how different analysts balance positives such as Boeing’s order backlog, production rates and market share against negatives like regulatory scrutiny and competitive pressures. In doing so, FintechZoom shows investors just how complicated Boeing’s place in aerospace is, and how many different dimensions there are to Boeing stock.

To be clear: FintechZoom is not saying that the good times are here again: its call for diversity of voices in its headline covers expectations both on a monthly basis as well over the long-term. Boeing quarterly results, strategic announcements and industry developments are analyzed by the platform to illustrate various ways in which different market participants view the future of the aircraft manufacturer. FintechZoom attempts to reorient readers with this in-depth analysis that offers perspective and sheds light on those subjective pieces of information.

The platform also takes into account the flux of perspective between a bullish and bearish outlook in varying market environments or geopolitical occurrences. FintechZoom provides the most comprehensive coverage of FintechZoom Boeing bulls argue that aircraft sales will eventually bounce back, giving the shares room to fly again. This way, it helps users to decide with more clarity, what is the potential upside coupled with risk in investing into Boeing stock.

What Investment Strategies Does FintechZoom Suggest for Boeing Stock?

Long-term vs. Short-term Investment Approaches for Boeing Stock

Investors looking for exposure to Boeing through a long-term position may have different criteria than investors interested in trading (i.e., speculation) on the stock. These include Boeing s extremely entrenched position in the aerospace market, wide exposure to both commercial and defense markets as well as space, and opportunities for new product development and growth that are not reflected in its current price for long-term oriented investors.

Boeing is facing challenges recently, but patient investors might be able to capitalize on its recovery from troubled times in the aerospace sector. On a broader scale, the platform suggests watching Boeing’s movement in both its 737 MAX program, new aircraft development and emerging market growth as potential signals of value creation for long-run investors.

On the other hand, FintechZoom points out that there are possible trading opportunities for Boeing stock day trading due to its volatility characteristics and instead factors such as quarterly earnings reports, new aircraft orders and regulations can drive changes in the price of equities. The service suggests that instead, short-term traders pay an added close attention to potential catalysts like significant contract wins, production milestones, or sector news.

But FintechZoom warns that with the company being so tied to external forces, short-term trading in Boeing stock is riskier the platform’s data indicated that short-term investors need to be ready for quick swings in both directions and establish a set point at which they plan to sell out of their holdings agreed between the amount of risk. With both long-term and short-term methods included, FintechZoom gives a clearer view on what are the investment strategies for Boeing stock that may suit their individual strategy to align it with their financial goals and risk tolerance.

| Strategy | Description |

| Long-term Investment | Focus on Boeing’s market position, diverse portfolio, and potential for innovation |

| Short-term Trading | Capitalize on stock volatility driven by earnings reports, orders, and regulatory decisions |

| Diversification | Balance Boeing stock with other aerospace and defense sector investments |

| Risk Mitigation | Monitor financial health, regulatory developments, and geopolitical factors |

| Options Strategies | Use protective puts for downside protection and covered calls for income generation |

| Dollar-Cost Averaging | Mitigate impact of short-term price fluctuations through regular investments |

Risk Management Strategies for Investing in Boeing

FintechZoom Recent analysis also includes about a risk management and Stock volatility measures that we will Observe on Boeing stock. The platform underlines the requirement of diversification as being a fundamentally necessary risk mitigation strategy, warning investors not to put too much faith on any individual stock like Boeing. This suggests that investors might consider Boeing as a part of a broader aerospace and defense sector allocation in the hope of balancing company-specific risk with industry-wide trends, writes FintechZoom

The platform likewise suggests that investors keep a close eye on Boeing’s financial condition, particularly its debt burden and cash flow to gauge the company’s resilience in facing challenges and opportunities to capitalize on future growth. Furthermore, FintechZoom suggests that existing and potential investors should keep a close eye on regulatory news as well as the changing geopolitical landscape affecting Boeing’s bottom-line.

Moreover, for more advanced investors, FintechZoom has risk management strategies to help make sure your Boeing stock fits you perfectly. The platform offers an explanation of how protective puts can be used to help limit downside risk, and that covered calls can potentially generate additional income from already existing Boeing stock holdings. FintechZoom also offered the following as a tip for investors who are worried about short-term volatility — think of dollar-cost averaging as a tactic to dampen price swings.

READ MORE ARTICLES HERE: HTTPS://RAASHQ.COM/

FAQ

Q: What is FintechZoom and what does it bring to the table about Boeing´s stock?

A: I frequently touchdown at FintechZoom last where you guys do a pretty serious stock market analysis including up-close look at how Boeing stocks are performing. This platform offers the most current information, expert rankings and stock trends to inform aspiring buyers regarding Boeing stocks and other stocks purchased in New York Stock Exchange.

Q: How the COVID-19 pandemic has hit Boeing hard and led to weak stock performance?

A: Which has resulted in reduced bookings for new aircraft and cancellations of orders already placed. This has fueled a rollercoaster ride for Boeing’s share price that has seen the stock spike and plunge as market reacts to news of vaccine breakthroughs and airlines beginning to return flights to the skies.

Q: Is FintechZoom: The Current Trend in Boeing Stock Market Trends?

A: FintechZoom market analysis confirms investor interest in Boeing stock as well. It’s not all roses for the company, of course, but there is renewed hope within a resurgent aerospace space. The stock has held up well, with some bulls seeing a path to recovery as demand for air travel rises and Boeing works through its production flaws.

Q: What is Boeing and where do they stand in the aerospace industry — as of March 23, 2019?

A: Boeing is the world largest aerospace company and leading manufacturer of commercial jetliners and defense, space and security systems. Although it has been a bumpy ride lately, Boeing is still a major player in the aviation industry. The company remains well-positioned to capitalize on the long-term global aircraft demand growth — especially in key emerging markets — and continues as a significant contributor to the U.S. economy and national security.

Q: What things can drive Boeing stock in future?

A: Air travel and economic conditions are influenced by a variety of interrelated elements, which can impact Boeing stock in turn. In addition, geopolitical events and the price of fuel as well as technological advances in aviation could affect Boeing’s outlook and by extension its stock movement.

Q: How much does FintechZoom currently target Boeing stock price?

A: What Price Target Has Boeing Been Given FintechZoom Releases. Although price targets are frequently adjusted, FintechZoom explains that it bases its analysis on aspects like Boeing’s order backlog, delivery rates, financial condition and overall market trends in the aerospace sector in providing a glimpse of possible future stock performances.

Q: Any takeaways from FintechZoom on how to make sense of Boeing stock performance?

A: FintechZoom offers a complete take on the stock performance of Boeing. Their scrutiny will look at financial statements, industry trends, order book and delivery rates as well as broader economic data. They also recommend monitoring analyst reports as well as any company or regulatory developments that could affect the future outlook of Boeing.

Q: How has Boeing done handling stock splits over the years and what should investors make of it?

A: Boeing has had several stock splits over its history. Stock splits in and of themselves do not alter the value of an investor’s position, but rather can alter the stock price and may increase trading volume. Boeing stock split history provided by FintechZoom allows investors to understand more long-term price trends and adjust investment strategy accordingly.

Q: Is Boeing stock a good buy compared to others in the aerospace sector?

A: Boeing has a market capitalization of $84.66 billion and generates $58.16 billion in revenue each year. The interest rates and currency exchange rates may cause the value of ratemaking liabilities to increase or decrease based on changes to discount rates used to estimate amounts for capital adequacy testing purposes, certain asset-liability management decisions and time pledge notes receivable drawdown amount (refer to Bear Stearns Steever Soley Valuation).

Though Boeing is beset by problems, there are dynamics in play that mean it still has some growth as the world returns to normality and commercial air travel increases again. As always, would-be investors in BA stock should first ponder their risk tolerance and seek further due diligence through FintechZoom.

Q: What financial metrics should investors keep track of when it comes to Boeing stock?

A: FintechZoom lists out a few key performance indicators to watch for Boeing stock, including revenue growth, its profit margins, order backlog numbers, delivery rates, and free cash flow. Also on the investor watch list are Boeing’s debt levels, research and development spending, as well as its efforts to address production issues and regulatory problems. Together, these factors give a more complete picture of Boeing’s financial health and the economic future of the entire aerospace sector.