Silicon Storage Technology (SST) stands as a top player in crafting embedded flash memory tech. It’s caused a stir in the semiconductor sector. With money minded folks and market pros watching SST’s stocks and recent moves, we’ll look into the firm’s market stance, money news, and what happened when Microchip Technology Incorporated bought them.

What is the current SST stock price and recent performance?

SST stock price history and trends

People who buy and sell stocks have been eyeing Silicon Storage Technology. Over the years, the value of SST’s stocks on the Nasdaq has seen ups and downs. Traded as SSTI, these stocks have withstood market movement. Watchers of SST, in response to changes in the chip making industry and in the firm’s direction in the flash memory field, have kept their eyes on SST’s trends.

The worth of SST stocks can shift due to many things. This includes new technology, people desiring flash memory products, and how well the business is doing in dollars and cents. The company’s SuperFlash® tool has had a big part in helping investors make choices about the stocks they buy. As we see more uses for embedded flash memory, from items we use every day to cars, SST has become more important in the marketplace. This might mean a push in the right direction for their stock value.

| Category | Details |

| Current Stock Price | Not applicable (SST is no longer publicly traded) |

| Final Acquisition Price | $3.05 per share (acquired by Microchip Technology) |

| Ticker Symbol | SSTI (prior to acquisition) |

| Market Exchange | Nasdaq |

| Acquisition Date | 2010 |

Recent stock price movements on Nasdaq

People are carefully watching Silicon Storage Technology stock movements on Nasdaq. The stock’s had significant ups and downs, reflecting bigger trends or unique events within the company. One such event was the merger announcement with Microchip Technology Incorporated. This news sparked lots of trading and the stock price changed a lot. Investors are showing more interest in SST on Nasdaq.

They want to see how Microchip acquiring the company could affect its future. Many things have influenced the stock’s price, like quarterly earnings, analyst suggestions and general trends in the semiconductor industry especially with regards to the Microchip merger. Traders are using things like MarketScreener to keep up with SST’s performance. This information helps them make decisions based on real-time data and expert opinions.

Here is the Live Chart:

Comparison to semiconductor industry benchmarks

Let’s talk about Silicon Storage Technology, how it performs against related businesses in the semiconductor world. The company’s special interest in embedded flash memory tech makes it stand out in the overall semiconductor market. To see how SST fares, we often compare it to others in the flash memory and microcontroller zones. This comparison can show investors what’s strong about SST and where it holds its place in the market. Sometimes, analyst opinions show that SST doesn’t always align with general semiconductor trends.

Why? Because of its focus area and things like the goings-on with the Microchip takeover news. Things that sway the company’s stock include progress with SuperFlash® tech, contracts with big-name electronic makers, and more calls for embedded flash solutions in all sorts of applications. If you’re an investor thinking about how SST does against industry standards, think about things like revenue growth, profit margins, and how much of the embedded flash memory market it owns.

How has the Microchip acquisition affected SST’s market position?

Details of the merger agreement with Microchip

Silicon Storage Technology (SST) and Microchip Technology Incorporated definitely hit a major point when they decided to merge. What happened was this: Microchip bought SST for $3.05 a share, all in cash. That made SST worth more than its market price. The plan? Get SST’s smart brains in embedded flash memory to work with Microchip’s huge line of microcontroller and analog stuff. The deal needed a good, hard look by some pretty tough people. Big regulatory groups and stock owners all had a say.

SST’s own Full Value Committee chipped in to help figure out if the offer was right and fair for SST stock owners. Plus, there were a whole bunch of steps – they looked at all the details, the stock owners had to say “Yes!”, and the right clearances were gotten. All through that time, SST and Microchip were explaining. They talked about why this was good for people that owned their stocks, that worked for them, and that bought their stuff. They talked about new ideas, new products, and growing their market. All possible because SST and Microchip are now on the same team.

| Detail | Description |

| Acquisition Value | $3.05 per share in cash |

| Strategic Purpose | Combine SST’s embedded flash memory expertise with Microchip’s portfolio |

| Regulatory Scrutiny | Involved due diligence, shareholder approval, and regulatory clearances |

| Impact on Shareholders | Immediate value creation and stock price volatility |

Impact on SST shareholders and stock value

The buyout by Microchip deeply affected SST owners and the worth of the company’s shares. After news of the merger broke, SST’s share price became wildly unpredictable. Investors were weighing up the meaning of the merger. SST owners enjoyed the bonus offered by Microchip. It was a big jump from SST’s share price before the announcement. This sudden increase brought quick gain for current owners and sparked a surge in SST share movements. This purchase caused a shift in SST’s shareholder makeup. Investors assessed their stakes, factoring in the merger.

Long-term owners faced a decision. Hang onto their shares until the merger was done, or sell on an open exchange. The SST Full Value Committee was key in making sure owners’ interests were safeguarded during the merger. As the acquisition proceeded, market experts kept a close watch on the share performance. They offered insights and suggestions to investors working their way through this big business change.

Changes in SST’s business strategy post-acquisition

When Microchip bought Silicon Storage Technology, things changed a lot. The new plan was to use SST’s special SuperFlash® technology in Microchip’s many products. This would make the combined company’s flash memory technology way better. Plus, SST could spread to new areas, thanks to Microchip’s worldwide reach and its strong customer base, especially in finance.

The strategy after the purchase also changed SST’s research to match Microchip’s ongoing projects. This sped up the creation of new flash solutions. Mainly, these were for cars, factories, and everyday items. The joined companies aimed to spread licensing deals for SuperFlash® technology. They saw a big demand for reliable, top-quality memory solutions in new tech areas like IoT devices and artificial intelligence. These strategic shifts prepared the new, unified company to compete better in the fast-changing semiconductor market.

What are the latest financial updates for Silicon Storage Technology Inc?

Recent quarterly earnings and profit reports

Silicon Storage Technology’s latest financial update has caught the eye of savvy investors and market observers. Microchip’s purchase of SST means the joined businesses’ performance is now key. Their most recent earnings report shows hopeful signs of increased income, especially in areas where SST’s embedded flash memory tech is used.

Analysts have also kept a keen eye on how SST’s operations affect Microchip’s bottom line. It seems the merger is starting to pay off, with better processes and cost benefits showing up. Shareholders have tuned into how products powered by SuperFlash® tech are doing. These could be big wins for the combined company. Financial updates offer a peek into how well tech licensing is doing and how fast SST’s tech is catching on across different sectors.

Key financial metrics and valuation

Microchip’s purchase of Silicon Storage Technology (SST) has brought changes. Today, experts look at how SST’s tech part plays in Microchip’s wallet. Key points are their money growth, gross margins, and investment returns on R&D for SuperFlash® tech. How much SST’s smart property and role in Microchip’s market price is worth has also become a big deal.

People keeping an eye on Microchip’s moves also care about cash flow, amount of debt, and money spent for growth. The value of SST’s tech agreements is now a hot topic. It shows how important smart property is in the chip industry. Microchip is bringing in SST’s work and tech. So, finance guys are tweaking their value charts to show accurately where Microchip stands and how it might grow in the chip market.

Analyst opinions and future projections

Most folks think Silicon Storage Tech, now part of Microchip, has a positive future. This move, experts say, makes Microchip stronger in the embedded memory field. They’re excited about Microchip using SST’s SuperFlash® in many products. Future predictions often mention rising growth in areas like car electronics, IoT devices, and factories. They expect these areas to need more top-notch, trustworthy flash memory.

Many have updated their big picture growth estimates for Microchip to include the benefit of SST’s tech and brainy property. People think profits will get better as the two companies mesh together and save money. They believe there will be more contracts to use their technology which can earn them more money. Yes, the semiconductor industry is fierce. But, a lot of experts still believe in the merged company’s ability to create cool stuff and increase their control over the latest tech.

How is SST’s SuperFlash® technology performing in the market?

Applications and adoption of SuperFlash® technology

The SuperFlash® tech from SST is popular. Many markets find it useful and reliable for their flash memory needs. It’s especially liked in car systems. Here, the tech’s strong durability and data storage are great for important safety tools and entertaining features. Companies making consumer electronics love SuperFlash® too. They put it in all sorts of things from phones to smart appliances at home. Its advantages?

Low power use and speedy reading/writing of data! Businesses in the industrial field like SuperFlash® too. Their machines, like programmable logic controllers and automation tools, rely on solid, lasting memory – that’s SuperFlash®. It’s adaptable to fit many situations, from low-power internet things to high-power computer systems. As we see more demand for computing at the edges and devices powered by AI, SuperFlash® is in the correct place. It is ready to help meet growing needs for quick, dependable, power-saving memory in a wide variety of uses and sectors.

Licensing agreements and partnerships

Silicon Storage Technology’s strong link-up with licensing bodies and partners expands its SuperFlash® technology’s impact. These key cooperations have boosted the use of SST’s built-in flash memory solutions in many sectors. Big semiconductor producers have given the green light to SuperFlash® technology, enhancing their products, as they appreciate its worth in fulfilling modern electronic systems’ strict demands. SST’s alliances go beyond usual semiconductor folks to foundries and integrated device manufacturers (IDMs).

These bonds have helped SST stretch its technology across varied process nodes and manufacturing abilities. It’s also teamed up with design tool suppliers and intellectual property (IP) corporations to make all-inclusive solutions. These simplify the blending of SuperFlash® technology into complex system-on-chip (SoC) patterns. These licensing pacts and partnerships not only rake in money through royalties but also cement SST’s robust place in the built-in flash memory environment, bolstering its market security.

Competition in the embedded flash memory space

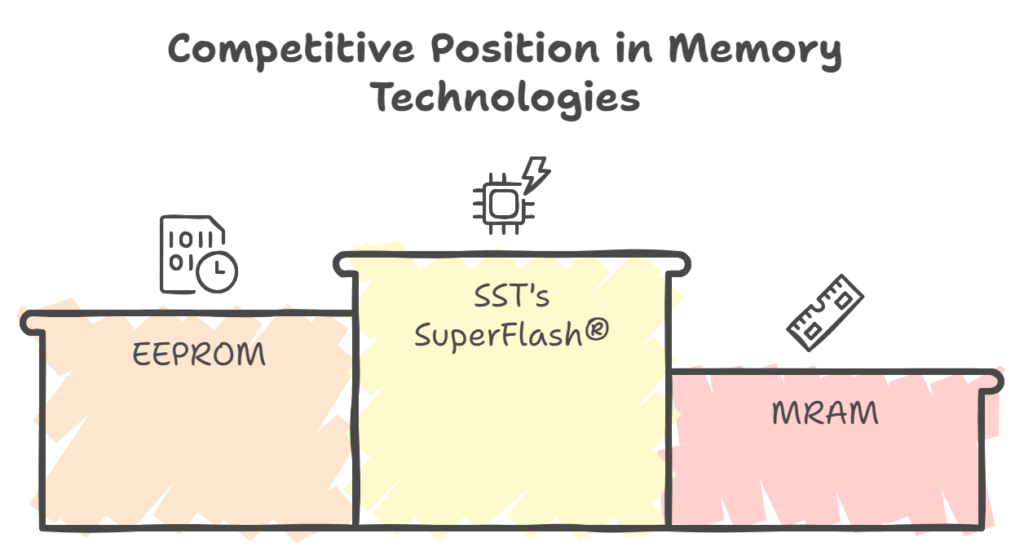

There’s a tough race in the field of embedded flash memory. Many companies are racing to the top, including SST with their SuperFlash® tech. They’re up against other options like EEPROM, MRAM, and newbies like ReRAM. Still, SST stays in the lead by keeping their tech fresh. They focus on better density, performance, and power-saving. What sets SuperFlash® apart is its reliable track record, especially when constant data storage and lots of writing is involved.

Now teamed up with Microchip, SuperFlash® gets even better. Paired with Microchip’s robust selection of microcontrollers and analog products, they can create more complete, tailored solutions for their customers. The race for the best in embedded flash memory has heated up. More edge computing and IoT devices mean everyone has to step up their game. Regardless, SST stays devoted to research and growth. They’re looking at improved designs and resources to keep up with the changing market and stay one step ahead of the rest.

What recent press releases or announcements has SST made?

Product launches and technology updates

Silicon Storage Technology has improved a lot since joining Microchip. They’ve achieved a lot, especially in SuperFlash® technology. They’ve improved memory size, read/write speeds, and reduced power use. They’ve targeted these updates at industries like automotive and industrial applications. Why? Because reliability and performance are super important in those harsh environments. SST also just announced they’re launching new products. These combine SuperFlash® technology with Microchip’s microcontroller and analog options, resulting in all-inclusive solutions for different markets.

These solutions help meet the demand for smart, connected devices. This is especially important in the expanding world of IoT. And guess what? SST has new roadmaps to show! These detail their future plans for integrated flash memory. They have plans to scale up to advanced processes and to research unique memory shapes. This research aims to support new applications in the exciting fields of artificial intelligence and machine learning.

Corporate news and leadership changes

Since Microchip bought Silicon Storage Technology, a few business changes have happened. The company told everyone through bulletins and news articles. They shared news about joining the two companies together. They talked about how SST’s work and people are now part of the bigger Microchip family. Changes in the rank-and-file were also shared, and the old SST top-brass have a new place in the Microchip’s set-up.

News about company plans meant to use SST’s know-how over Microchip’s various products has also gotten attention. News articles have talked about the firm’s dedication to keeping and growing SST’s research and production strengths. They want to keep making new stuff in the realm of inbuilt flash memory tech. Besides, they’ve discussed ways to make the company more efficient, perfect supply lines, and boost support for products using SuperFlash® tech. These company updates keep stakeholders, buyers, and those that watch the industry updated on SST’s future under Microchip.

Industry events and conference participation

Being part of Microchip, Silicon Storage Technology actively takes part in tech events and shows. Here, it reveals the latest with its embedded flash memory tech. big trade shows like Embedded World and the Consumer Electronics Show (CES) are some examples. At these events, SuperFlash® technology is shown off. This tech is used in many areas, like cars, IoT, and industrial tasks. The company doesn’t just show up at these events, it contributes. SST’s pros give presentations and talks at events that focus on memory tech and embedded systems.

This is where they share knowledge about changes in the industry, tech troubles, and what can happen next with non-volatile memory tech. Plus, SST hosts webinars and workshops to teach customers and partners about SuperFlash® tech. This helps improve understanding of its worth when making embedded systems secure. By being part of these events, SST gets more attention in the industry. It also builds partnerships, and encourages use of its tech in various market segments.

How can investors access SST stock information and make informed decisions?

Tools for tracking SST stock on MarketScreener

For those keen on Silicon Storage Technology stocks, MarketScreener is handy. It’s packed with financial market data. It gives real-time quotes, past price charts, and SST shares trading volume. This lets you track price changes, spot trends, and match SST against industry standards. Plus, it has tech analysis tools. You can use indicators and chart patterns for a deeper dive into SST’s stock data. MarketScreener doesn’t just focus on prices. It also offers access to financial reports, profits news, and SST specific analyst reviews.

Users can set up tailored alerts for major price changes, breaking news, or analyst rating shifts. Its news gathering feature rounds up related articles and press statements. This keeps you up-to-date on happenings that might affect SST’s stock price. Using these tools, stock watchers can get a complete picture of SST’s market standing. They can make smarter investment choices, grounded in both technical and fundamental analysis, plus insights into security details.

| Tool/Resource | Description |

| MarketScreener | Provides real-time stock quotes, historical price charts, and trading volume data |

| Financial Reports | Access to earnings announcements and analyst recommendations |

| Alerts | Customizable notifications for significant price movements or news releases |

| Market Position Analysis | Understanding SST’s market share and competitive landscape within the semiconductor industry |

Understanding SST’s position in the semiconductor market

Investors need to grasp SST’s standing in the larger semiconductor market to make well-informed investment choices. This means checking out the firm’s market slice in the embedded flash memory sector; its tech perks; and its competitive setting. Evaluating SST’s connections with main buyers, partners, and licensing deals gives clues about its long-term earnings capability and market clout.

Besides, knowing SST’s part in Microchip’s total game plan is key in gauging its future promise. Dig into how SST’s SuperFlash® tech boosts Microchip’s product range and boosts the firm’s expansion in target sectors like cars, industrial use, and consumer electronics. Staying clued-up on industry shifts, such as IoT device uptake, car electronics evolution, and artificial intelligence progress, helps track SST’s long-term growth and originality potential in the semiconductor field.

Evaluating investment potential and risks

When dealing with Silicon Storage Technology, it’s important to study not only the company but also the market. SST’s financial health, including things like how their profits are growing, their profit margin, and how much value their research creates, is vital. The Microchip merger plays a role too. SST’s technology portfolio and their ability to make money through licensing agreements and partnerships also matter.

There are also risks such as how cut-throat the semiconductor market is, possible tech shake-ups, and how the economy might affect the demand for electronics. Global politics can muddle tech sector supply chains and trade too. But it’s not all bad news. Alongside these risks, one must also look at the positives – SST’s strong standing in the embedded flash memory market and the potential benefits from the Microchip takeover. With all this in mind, investing in SST’s stock can be more calculated.

READ MORE ARTICLES HERE: HTTPS://RAASHQ.COM/

FAQ

Q: Can you tell me about the Silicon Storage Technology (SST) stock’s current situation?

A: The Silicon Storage Technology (SST) stock isn’t on the market for public trading. Microchip Technology procured them in 2010, purchasing each share at $3.05, making SST a private company. Thus, SST shares cannot be traded on any public stock markets.

Q: What are my options if I want to invest in Silicon Storage Technology (SST)?

A: Sadly, you cannot directly invest in Silicon Storage Technology (SST) anymore since it’s a private firm now. But for those with an interest in the semiconductor sector, contemplate investing in Microchip Technology, the firm which bought out SST, or other leading microcontroller and analog semiconductor providers.

Q: Can you provide information about Silicon Storage Technology’s (SST) stock price before they merged?

A: Silicon Storage Technology’s stock price exemplified the semiconductor industry’s typical variability. It’s last stock price was defined by the new merger agreement with Microchip Technology, which valued SST at $3.05 for every share, in cash. More detailed historical data could be found in financial records or databases related to stocks.

Q: Could you explain SuperFlash technology and its connection to SST?

A: SST created SuperFlash technology, a distinct memory technology. It’s utilized extensively in the digital consumer, communication, and automotive domains. SST’s product line prominently featured this technology, signifying its importance until Microchip’s merger.

Q: What was the effect on shareholders from the merger of Silicon Storage Technology and Microchip Technology?

A: The connection of SST with Microchip Technology, affirmed by SST’s board after thorough thought, afforded SST shareholders $3.05 per each outstanding share. This trade gave shareholders a solid value for their shares, wrapping up SST’s presence as a publicly-traded self-governing company.

Q: Can you name some of Silicon Storage Technology’s products?

A: Silicon Storage Technology was a top source of memory and non-memory items for many uses. They made microcontroller semiconductors and analog, focused on digital gadgets, communications, and car-grade parts. SST’s products aimed to serve the increasing need for advanced chip solutions in these fields.

Q: How can I find Silicon Storage Technology’s financial calendar or reports today?

A: Silicon Storage Technology, now part of Microchip Technology as a private company, doesn’t release its individual financial calendar or reports anymore to the public. Those interested in semiconductor technologies and products from SST should look at investor materials and finance disclosures of Microchip Technology.