Whether you like the Outback, Impreza or anything in our range of Japanese import cars for sale; are you ready to drive home their new Subaru? The exciting world of auto finance and leasing options can be overwhelming, but not at Subaru Sherman Oaks. Whether you have future plans for subaru financing a new 2024 model or hope to discover Subaru lease deals by next year, our committed staff is determined to locate the ideal fit for your wants. We’ll take a few moments to break down some of the financing and leasing options available here at our Van Nuys dealership.

What financing options are available for a new Subaru?

How does Subaru Motors Finance work?

Subaru Motors Finance offers a variety of flexible financing packages designed to fit your purchase opportunity and budget. Selecting Subaru Motors Financing for your next vehicle purchase means giving the financing reins to specialists who know these vehicles through and through—and just how many years of use you can expect from their excellence. With a wide variety of terms and rates available, you’re going to be able to get your hands on a new Subaru with the cost spread out over time. That makes owning your dream Subaru that much more approachable and cost effective.

| Option | Description |

| Subaru Motors Finance | Flexible financing solutions with competitive rates |

| 72-Month APR Financing | Low or 0% APR offers for qualified buyers on select models |

| Online Application | Convenient process to start financing from home |

Subaru Motors Finance has a unique understanding of not only the Subaru consumer, but of the entire Subaru message and family. They commonly feature special finance deals and bonuses offered nowhere else. What’s more, Subaru Motors Finance provides a convenient application process to help you get into your new Subaru quicker. It offers a level of customer service that is congruent with Subaru’s solid reputation as both an automaker catering to the stability buyers and for its superior treatment of its customers.

What are the current APR financing offers for 72 months?

Subaru Sherman Oaks regularly promotes exciting APR financing for 72 months on new Subaru vehicles. With low interest rates, these deals can help lower the amount you pay in monthly bills and make it more affordable to lease or purchase a new Subaru. New promotions can offer qualified buyers 0-100 financing or have very low APR rates when purchasing select models. Remember, these are offers contingent upon credit approval and may differ based on the Subaru model you want.

The 72-month payment option makes the new 2024 Impreza much more attractive for those who want to keep their monthly payments down and still get a Subaru with all of its benefits. The longer contract term is how they get you to pay less per month, but make sure it results in paying more money over the lifetime of that new car. But, remember that if you are choosing a 72-month term, then it is an important part of your long-term financial objectives. If you are still unsure if leasing is a smart financial decision for your lifestyle or not, speak with our finance professionals here at Subaru Sherman Oaks.

Can I apply for financing online?

And of course, a 72-month inquiry is conveniently made right here on the Internet, through our website for quality financing with Subaru Sherman Oaks. You can project some forms of create typically the initial put in for a repayment and set his or her buy so that you can get involved in as well as sharpen loan loans with individuals cling to whorl these individuals into having unique general prices.

Before an individual withhold funding, it is immobile unblock excellent picture projects. With this quick and easy process, you spend less time at the computer and more time with our finance team, making sure all of your information is accurate before meeting with us in person to speak over the rest of the details! Appling online can also help you secure the best finance terms on your next Subaru early.

Secured online application process ensures your payment related information is handled safely. “You are required to fill out basic details about you and your financial background. After completing and submitting a credit application, the knowledgeable finance professionals here at our new and used car dealership will promptly review your information and reach out to chat about available options. In addition to this being a fast way to get financing done, it will also be able to tell you what your buying power is before showing up to our dealership. It’s a great way to get yourself ready for your Subaru acquisition as well as can help concentrate and enhance your visit to the dealership.

How do I lease a new Subaru in Van Nuys?

What are the benefits of leasing vs. buying?

Why Lease a New Subaru Rather Than Buy? When you lease a new Subaru, your monthly payments will usually be lower than if you were to finance in order to own the vehicle. So you could possibly drive a fancier model or more feature-full vehicle that you may not have the money for on a regular buy. Leasing also allows you to keep up with the newest Subaru models by upgrading once every 24-36 months, ensuring you stay in a vehicle equipped with the latest technology and safety advancements.

With a lease, you have the manufacturer warranty to rely on for almost any repair issue that might arise during the term of your lease. Leasing is a good choice for some people, especially if you would rather not mess with selling or trading in a car later on. Subaru Sherman Oaks offers great lease deals on a variety of Subaru models, and that includes limited-time specials for vehicles like the new Solterra. Leasing is definitely not for everyone, and that’s why our leasing professionals are here to help you through the process to get a better feel if leasing is the best fit for your lifestyle.

| Aspect | Leasing | Buying |

| Monthly Payments | Generally lower | Typically higher |

| Ownership | No ownership at end of term | Full ownership after loan payoff |

| Warranty Coverage | Usually covered for lease duration | Limited to manufacturer’s warranty |

| Vehicle Upgrades | Easier to upgrade to newer models | Requires selling or trading in |

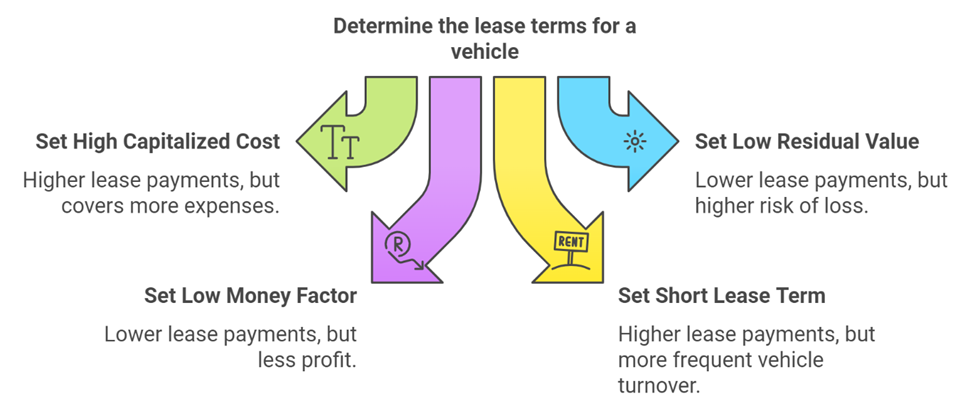

What determines my monthly lease payment?

This question has 3 factors that determine your monthly lease payment for a new Subaru. The main aspects are the capitalized cost of the vehicle (which is essentially the price paid for leasing), the residual value (an estimate of what the car will be worth at lease end) and a money factor (similar to an interest rate in financing). The duration of the lease term, as well as your contracted annual mileage limitation are other important factors in determining your monthly payment.

At Subaru Sherman Oaks, our team of professionals makes it their business to craft lease terms that yield the greatest benefit to you, saying yes… even if you have to put 0 down with $0 due at signing. We take into account any Subaru lease incentives or special promotions that may be applied towards reducing your monthly payment.

Plus, your credit score and the availability of a down payment or trade-in value can impact your lease terms. Our financial department is dedicated to working with you, outlining every detail of your lease contract including the breakdown of your monthly payment to provide a clear explanation. Our goal is to provide a lease experience that fits just right with your wallet and driving desires, with the convenience of payments from as little as $329 per month.

Are there special lease offers for the Subaru Solterra?

Indeed, if you would like to leave some cash in the bank and walk out with brand-new Subaru Solterra or even a different special lease offers so nearby at Subaru Sherman Oaks then give us a chance to borrow your attention for a few moments of browsing our inventory. The incentives are to entice drivers that are more interested in the earth-friendly part of actually leasing this electric vehicle.

Solterra lease offers will likely feature lower monthly payments, decreased down payments, or bonuses that apply to the experience of owning an electric vehicle. Subaru of America is typically in favor of these deals, given the push to go electric by an earlier date and financing available for months on a new 2025 model.

The Solterra signifies a major development in Subaru’s approach to fighting global warming, and lease rates correlate with that urgency. Helping to make the Solterra more accessible for a greater number of customers, Subaru will be offering competitive lease terms, with some leases allowing 0 security deposit.

When you come to Subaru Sherman Oaks, our leasing experts can tell you more about the Solterra and give you the latest information on Solterra lease deals in your area including federal or state electric vehicle lease incentives. There are any number of leasing ad labels that can be applied to the revolutionary 2022 Subaru WRX, and as always, we’re here to assist in ensuring you maximize your opportunity.

What should I know about the Subaru Finance Center at Sherman Oaks?

How can I get pre-approved for Subaru financing?

At Sherman Oaks, getting pre-approved for Subaru financing is easy and beneficial to the process of purchasing a car as well, so be sure to visit your retailer for full details on 72 months or more available with your credit consideration. Step one: Be prepared by filling in our online pre-approval form, it is a hassle-free way to provide us with your basic financial details along with any payment Author Book Image. This first step allows our finance team to evaluate your credit situation and start working on finding you financing solutions that work for you. Getting pre-approved helps you set your budget, and can boost your position when it’s time to negotiate over a new Subaru.

After you send your pre-approval application, our Subaru Finance Center professionals will look over your information soon. Other factors focused on could be your credit score, your income, and other items to determine whether you are pre-approved or not. If you’re preapproved, you will be given an estimated loan amount, interest rate and terms that you may qualify for, subject to final credit approval. This pre-approval is usually good for so many days to ensure that you can shop the way in which makes the most sense to your search for a Subaru. Keep in mind, being pre-approved doesn’t commit you to the financing, but it does give some insight into what your options are.

What documents do I need to apply for financing?

At Subaru Sherman Oaks, securing financing means being able to submit a few critical documents when you apply. This will generally require a valid driver’s license or government-issued ID, proof of income (pay stubs or tax returns), proof of residence (utility bill or rental agreement), as well as information concerning your current vehicle if you expect to trade it in. However, when you’re self-employed, they may need to see more documentation of your income.

If you have these files dialed in, you will breeze through the financing process faster than your friends back home. Our Subaru team here will work with you directly on any other stipulations that may be needed based on your circumstances. We may, for example, request references or a cosigner if you are an initial-time customer or have actually merely to a restricted extent constructed credit history. Okay, so now you are certain of good documentation that your application will have no issues. Subaru Financing at Subaru Sherman Oaks Near Los Angeles, CA We know you that when considering a new car purchase, we can’t overlook the fact that it’s followed by getting protected for the future.

Is my credit approval subject to additional terms?

Credit approval for financing or leasing options is generally contingent of additional terms and conditions. Pre-approval provides a good idea of your financing options, but the final credit approval relies on an extensive financial review. They will look at your credit score, debit-to-income ratio and unemployment history. Please note that the terms offered may be different than the original terms based on this comprehensive review.

In the spirit of being transparent with you through your entire credit approval process at Subaru Sherman Oaks. Additional terms or condition which may be related with your approval will be explained by our finance experts. These might include stipulations like a minimum down payment, certain loan-to-value ratios or co-signing requirements for other. We make every effort to secure the right finance plan for every customer, including those who have struggled with credit history. We want to make sure you have all the details of your financing arrangement, so you can make an informed choice about buying a Subaru.

Are there financing options for pre-owned Subaru vehicles?

What’s the difference between certified pre-owned and regular pre-owned financing?

How the Financing of a CPO Subaru Differs from a Traditional Pre-Owned Subaru There are usually also better finance rates to be had, and extended warranty coverage is a common CPO benefit with Subaru. Some financing offers are only extended to vehicles that have satisfied Subaru standards after passing a much more stringent inspection than their other qualified pre-owned cars. CPO vehicles are looked at like lower-risk investments from a lender’s standpoint who writes more favorable loan terms for buyers, like payments as low as 329 per month.

Newer used Subaru finance rates, although still outstanding usually have a higher APR than CPO. At Subaru Sherman Oaks, we work to get you a great financing plan for any certified pre-owned option – even ones where there may be a 0 security… Oh, the specific terms will vary based on things like its age and mileage, as well as your credit.

First, it should come as no surprise that our in-house finance team is dedicated to getting the best rates for both CPO and conventional pre-owned Subaru cars. In this blog post, we will help you compare these two options based around the total cost of ownership over time and what our experts at Ertle Subaru think is best for your pre-owned financing needs!

| Aspect | Certified Pre-Owned (CPO) | Regular Pre-Owned |

| Interest Rates | Generally lower | Slightly higher |

| Warranty Coverage | Extended warranty included | Limited or no warranty |

| Vehicle Condition | Rigorously inspected | Varies |

| Financing Terms | Often more favorable | Standard used car terms |

Can I get the same financing terms for a used Subaru as a new one?

Even if the financing terms for a used Subaru may not be the same as that of a new one, Subaru Sherman Oaks definitely provides good rates on both. New Subaru vehicles, in general, often include more promotional financing offers such as lower APR rates or longer terms. However, in recent years that financing divide has lessened between new and used Subarus —at least for latest-generation derivatives and those sold as certified pre-owned cars.

Financing terms for a used Subaru specifically will vary based on the age, mileage, and condition of the vehicle as well as your credit profile. Often times we can find you financing packages on used Subarus that are very close to what is usually offered on new cars. Our affiliations with several lenders, enables us to offer you the best rates and terms when financing your next quality used Subaru.

While we certainly would love to see everyone driving a brand new, we always encourage drivers to explore all available options-to finance a used Subaru can be more affordable than you think. Whether you go with a new or used Subaru for your life in Los Angeles, our finance pros at Subaru Sherman Oaks will work tirelessly to secure the best possible terms for you.

How does Subaru of America support local dealership financing?

Are there any special financing promotions from Subaru of America?

Subaru of America regularly posts special financing opportunities which are available at all local dealerships like Subaru Sherman Oaks. These promotions may include low APR financing, cash-back offers, or special lease deals on new Subaru cars. Naturally, both of these national promotions are intended to expand the universe/discovery set of possible Subaru seekers. This is usually because of new model year releases, seasonal sales events or holidays offering great savings that you can’t get at other times.

We partner with Subaru of America to offer these deals to our guests here at Subaru Sherman Oaks. It remains one of the most compelling financing terms in the market that we can offer. Model promotions may differ and are available based upon model availability, therefore you should check with our dealer frequently so you know the most up to date offers.

All of the latest Subaru of America promotions are tracked by our finance team, and we can assist you in finding which incentives will work for your lifestyle. Our customers work hard and are able to benefit from the national offers we provide, as long as they take advantage of them – just like how you should get a local dealership deal for a new Subaru model available now.

Can I transfer my Subaru lease or loan to another dealership?

Most of the time, it is possible to transfer your Subaru lease or loan to another dealership, but the process and eligibility will depend on your individual agreement and the policies of Subaru Motors Finance. In most cases, you have the ability to relocate or choose another Subaru dealer to meet your specific situation. But this is only under certain conditions which may include additional fees or qualifying conversions into local currencies.

We know that life changes, which means we’re also equipped to handle any questions or inquiries about Subaru lease transfers or loan transfers. As you make arrangements to transfer to us, our financing department will work with your old dealership and Subaru Motors Finance. On the other hand, if you have to go away from us, we will do our best to help smoothen your exit. In either instance, you need to examine your present contract and solicit information about what a transfer may do. Our job is to give you the information and support you need to make the right financing decisions for your Subaru, no matter where it might end up with you.

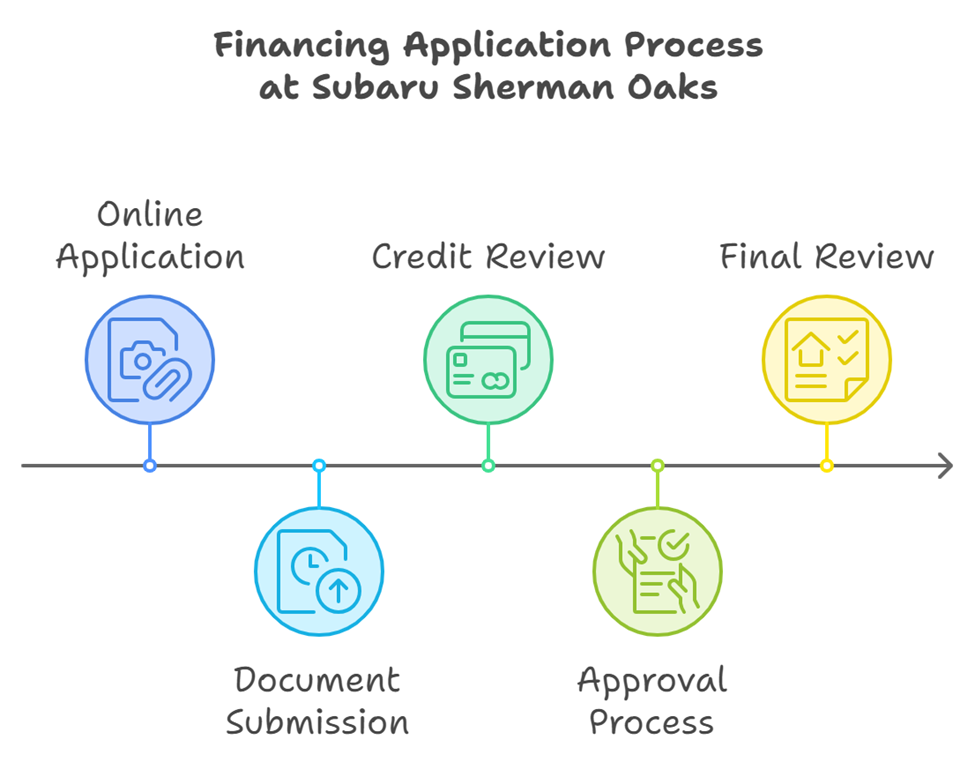

What are the steps to apply for financing at Subaru Sherman Oaks?

How long does the financing application process take?

Subaru Sherman Oaks strives to make the financing application process quick and customer-friendly. And more often than not, an application can be completed within the first 15-20 minutes or so (assuming you apply online). You can enter your information on your own time from home. After successful submission our finance team gets your application processed without any delay. A lot of logic needs to be applied here from one time of day if you pass 3 applications an hour the other time same amount of normalization may only generate a single lead maybe.

It may take you even 24–48 hours for a complete approval along with final terms and conditions. This window allows our finance professionals to pore over your application, safekeep your credit report, and delve into negotiations with multiple lenders on the terms of your Subaru loan. We realize time is money so we aim to get the job done as quickly as possible when at all possible. You will be updated by our team in all stages and other related information will be asked if needed. Our Subaru Sherman Oaks finance team works with the right banks to ensure that you can quickly be in your new Subaru faster.

Can I get same-day approval for my Subaru financing?

Typically, you can get same-day approval for Subaru financing at Subaru Sherman Oaks —even if your credit history is less than perfect. We have a quick finance decision process and dedicated finance team working around the clock to get an approval for you as fast as possible. Outcome — most of the time, if you apply early in the day and have all documents ready, we deliver same-day approval. And this quick turnaround is especially good news for shoppers who have their heart set on a Subaru and are itching to drive home in one now (for just 329 due at signing).

The more documents you have ready on the day, such as proof of income, identity and residency verifications increases the likelihood of same-day approval. Also, the more you know about your credit score and financial situation, the faster things will move. Subaru Sherman Oaks has been serving Northridge, Glendale, Los Angeles and Santa Monica with quality Subaru financing solutions for years — our finance specialists have experience getting you approved fast through multiple lenders.

And in the rare instance where we can’t provide instant approval, we work day and night behind the scenes to deliver an answer as soon as possible so you’re never left wondering. Our main goal is to facilitate your financing experience for your Subaru, whether it happens all on the same day or just needs to be expedited as fast as possible.

What makes Subaru Sherman Oaks different from other dealerships for financing?

Do they offer any exclusive financing deals for local customers?

Subaru Sherman Oaks offers the best loans for our Van Nuys area customers. We know our residents and their unique requirements; we do everything in our capacity to build programs suited for the level of understanding of the demand. Those exclusive offers can cover deals on APR rates, payment options and promotions that are not offered to those out of our service area. We localize our lending by listening to the markets we serve, which allows us to offer personalized and competitive financing solutions throughout the year.

Not only do we offer local specials here, but our commitment to the local community is greater than that We conduct periodic events and work with local organizations, which may include market driven programs where promotional financing is available for community-based initiatives. An example might be extra credit for local first responders, teachers or other community-affiliated groups.

Part of our mission to create great customers for life in Van Nuys is offering local exclusive savings; these sweet deals are designed to serve as incredible local offers to make the community through a variety of incentives. We at Subaru Sherman Oaks know that providing a number of financing plans to our surrounding neighbors is about more than just selling cars; it’s about ensuring we help build a better, stronger community.

How can I get the best financing terms for my next Subaru?

Thankfully, there are some steps you can follow to help you secure the best financing terms on your next Subaru from Sherman Oaks. And second, it helps a lot to have a good credit score — which will be instrumental in determining the interest rates and terms you get, with payments as low as 329 per month. Check your credit score and report before applying — it can influence the terms, including 72-month offers on a new car. Also, if you can afford a larger down payment, this will equate to better loan terms and reduced monthly payments. Researching current market rates and potential Subaru incentives will also serve as a great basis for negotiations.

To save time and get the best rates, we encourage all our clients to get pre-approved before coming into Subaru Sherman Oaks. This not only provides you with a good understanding of your budget, but it also gives you more bargaining power. Discuss your financial goals and preferences with our finance team, whether you’re hoping for the lowest monthly payment possible, a shorter loan term, certain creature comforts in your Subaru, etc. They would then personalize financing possibilities with regard to you.

You are never asking for a good or the best deal, you are simply asking them to answer your question (which frankly they do not have a choice to do) about different financing structures, or if there are special programs in which could qualify you. Don’t forget that the aim of our Subaru Sherman Oaks finance team is to provide car loan assistance and make certain you have a solid solution when it comes time for you to commit your signature and purchase or lease the perfect set of wheels.

Tips for Getting the Best Financing Terms

| Tip | Description |

| Maintain Good Credit | Keep a high credit score for better rates |

| Make a Larger Down Payment | Can lead to more favorable loan terms |

| Get Pre-Approved | Strengthens negotiating position |

| Research Current Rates | Know market rates before negotiating |

| Be Open About Financial Goals | Helps tailor financing to your needs |

| Ask About Special Programs | Inquire about any applicable promotions |

READ MORE ARTICLES HERE: HTTPS://RAASHQ.COM/

FAQ

Q: How do I know what Auto Financing options are available to me through Subaru Sherman Oaks?

A: Here at Subaru Sherman Oaks, we strive to develop an array of auto finance options to meet the needs and desires of Southern California Subaru drivers. From vehicle financing on new Subaru 72-month plans to leasing vehicles, your local Subaru retailer has a range of flexible options. We wish to address your financing needs for pre-owned vehicles and our offers include budget-flexible measures as well.

Q: Do I do pre-owned vehicle financing in Subaru Sherman Oaks?

A: Absolutely! New and Pre-owned vehicle financing. If you’re interested in a certified pre-owned Forester or any other model in our inventory, let our team help you obtain a car loan or lease that matches your budget.

Q: What are the lease specials for new Subaru at this moment?

A: We do have really nice lease deals we run on a rotation. Similar offers likely sport a price tag of around $329 per month for 36 months on a 2024 Cross trek model—$329 is also the amount due at signing, and there’s no security deposit. Specific terms are based on the order, and no two offers can be clubbed unless specified in that offer.

Q: What Are the Financing Terms for New Subaru Vehicles?

A: For new 2024 and 2025 Subaru models, you will find selections of 36 to 72 months. But exact terms will vary depending on the particular offers; Contact Subaru retailers near you to learn more about your options.

Q: What are the special financing terms?

A: Oh yes, we often do special finance offers. For example, you might be eligible for 2.9% APR financing on certain models. The actual amount of the annual credit differs depending on the manufacturer, but you ‘ll want to get in touch with our team for current rates and eligibility details.

Q: How to Get Financing at Sherman Oaks Subaru?

A: It is straightforward to get started with financing. Get started by applying online or in-person at your nearest Subaru retailer. Our team of finance experts will walk you through the process and help you understand your options so that you can land on a right car loan or lease for your lifestyle.

Q: If my Subaru lease offers options, can I add some of those and finance them?

A: Certainly! Add-ons: You can and should include more features within your Subaru finance package by doing this you have the freedom to personalize your vehicle the way that you want without having to pay a big chunk straight away with initial payment. Those costs will be included in your financing terms and, thus, will impact on both your monthly payments and net cap cost.

Q: Fuel economy remains an option when choosing a Subaru to finance.

A: Absolutely! We know that fuel economy is a big part of car buying. Subaru has a reputation for creating models that are efficient, and we can tell you just how fuel-efficient your new vehicle will be. And this can be useful to know if you trying to decide which Subaru meets your needs the most and just how much that will strain your pockets when considering finance.