Trek Financing powered by Citizens Pay makes starting a cycling adventure easier than ever. This solution completely revolutionizes the way in which bike lovers purchase bikes with giving them a choice to realize their dream of owning a high-end Trek bicycle. If you’re a seasoned rider or wish to upgrade your first bike, Trek financing has something for everyone in every budget.

What is Trek Financing and How Does It Work?

Understanding Trek Financing Powered by Citizens Pay

Trek Financing powered by Citizens Pay is a new service to offer an easier way for you who want to buy trek bike and accessories. The forward-thinking scheme is ideal for the most enthusiastic of riders, enabling cyclists to ride away on their dream Trek machine without burning a hole in their pocket. Through its partnership with Citizens Bank, Trek provides customers the dual power of a trusted financial institution and one of the top bicycle manufacturers in terms to quality lending experience.

The Customer Financing program uses intuitive online tools that work naturally within Trek’s existing online and in-store shopping experience platforms. We will show how easy the whole process is when customers apply for financing directly during checkout flow with instant credit decisions in order to gain trust and complete their purchase. In addition to the cost of purchasing a bike, this financing option also includes any Trek and Bontrager accessories or products cyclists may want in order to prepare themselves for their rides without leaving anything up to chance.

The Benefits of Trek’s Credit Card and Line of Credit Options

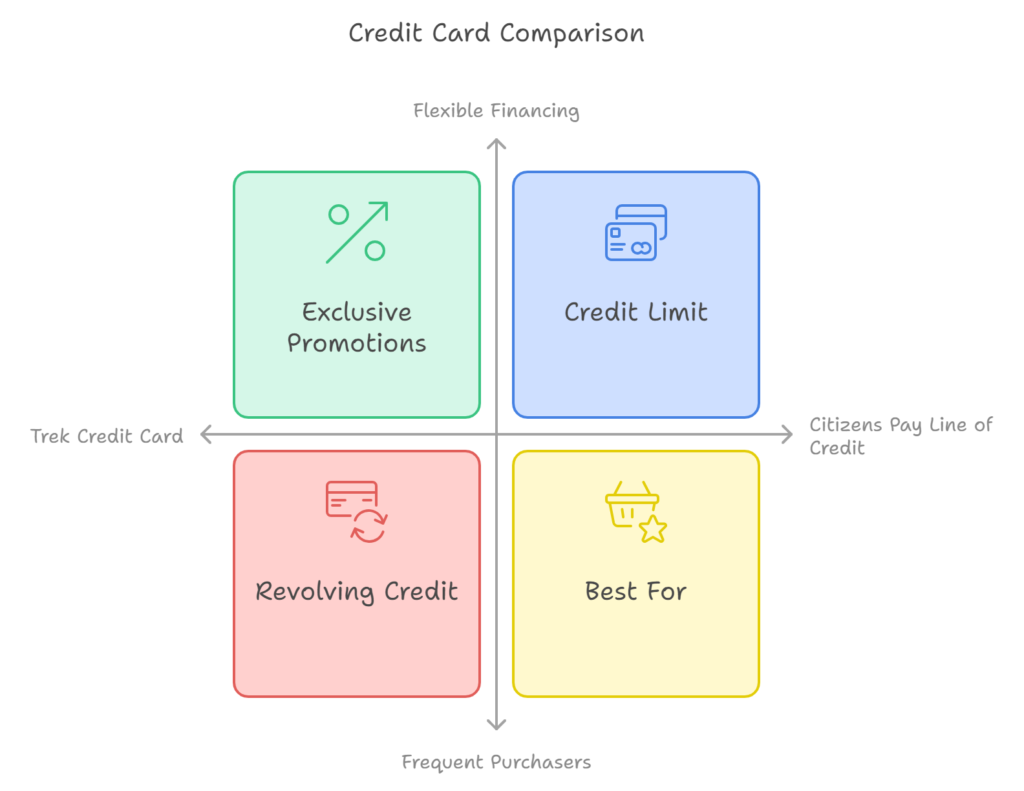

Trek Financing — Trek Credit Card & Citizens Pay Flow With special benefits and promotional financing, the Trek Card with a minimum purchase is your Key to Unlocking our Best Offers on all products site wide. The Trek Credit Card is a line of credit that helps cycling enthusiasts to get the things they want from Trek with special promotional offers. By contrast, the Citizens Pay Line of Credit offers a versatile financing method usable on multiple Trek products and accessories.

Both payment programs feature competitive APRs and flexible installment plans, so you can remain financially sound while stockpiling high-end cycling gear. The Trek Credit Card and Citizens Pay Line of Credit also provide prompt credit approval processes so customers can complete their purchases immediately. Strategic financing programs are in place to accommodate different tiers and levels of credit to help deliver Trek products into the hands of a variety customers.

| Feature | Trek Credit Card | Citizens Pay Line of Credit |

| Primary Use | Frequent Trek customers | Flexible, repeat purchase financing |

| Exclusive Benefits | Promotional financing offers, potential rewards | Revolving credit usable for multiple purchases |

| Approval Process | Quick credit decisions | Quick credit decisions |

| APR and Payment Plans | Competitive, includes promotional rates | Competitive, includes promotional rates |

Eligibility Requirements for Trek Financing

Citizens Bank does not enter into consumer finance agreements, and are unable to control the conduct of Summit Racing or Ming Specialist Automotive Finishes in connection with their approval process practices. Individual requirements differ, of course — typically you must be at least 18 years old and hold a valid government-issued ID as well as a good credit score. Factors such as credit history, income and existing debts are used by it to decide whether or not someone is able to qualify for a product offered through them. Keep in mind that Trek Financing wants to make deals with the largest possible number of clients, but a good credit score will help you get approved and obtaining more favorable terms.

All potential interested applicants will be required to submit personal and financial information as part of the application process. This may be things like work status, annual pay, Social Security number etc. The eligibility criteria are there to help make sure that we are lending in a responsible manner but they do also ensure our Trek bikes finance deals remain accessible for as many people as possible. If you fall into any of these categories then Trek Financing may be eligible for all the great deals that cycling enthusiasts can take advantage of.

| Criteria | Requirements |

| Age | At least 18 years old |

| Identification | Valid government-issued ID |

| Credit Score | Fair to good, though specific thresholds may vary |

| Additional Information | Employment status, annual income, and Social Security number required during application |

How Can I Finance My New Trek Bicycle?

Exploring Trek’s Financing Options

Trek Financing powered by Citizens Pay offers all the ways to pay available in options that make financing your new Trek easy and affordable. There are two main financing options available to customers; The Trek Credit Card and Citizens Pay Line of Credit — both with specific benefits that cater to different situations. If you receive a lot of Trek products, the Trek Credit Card is for you because it brings with itself certain exclusive deals and even rewards. The Citizens Pay Line of Credit offers near-instant purchasing power and provides a flexible revolving credit line that can be used for Trek purchases, offering long-term access to purchase bikes, accessories and more.

With competitive APRs and flexible payment plans, both financing options enable riders to break down the cost of their dream bike. It allows you to get into a high-end Trek bike, but not have too much of your money tied up from the start. One of the benefits that comes with choosing Trek Financing is, because Trek frequently runs special promo and finance deals like 0% APR for certain periods as well pay-in-full promotions specifically if you run over a threshold price, it gives customers yet one more reason to choose financing through Trek for their purchase.

Steps to Apply for Trek Credit Card or Citizens Pay Line of Credit

The Trek Financing application process is easy so you can get your new ride as soon as possible. First, customers must apply either online through the Trek website or in-store at a supported Trek Bicycle Store. Generally, the application will ask for your name, address, and date of birth along with your Social Security number. So, along with that the applicants also have to provide their financial records like how much they are earning annually and there any further information related making them more capable for repaying back. Once you submit the application, credit approval is quick – many customers receive a decision in minutes.

Once approved, customers can take advantage of their new Trek Credit Card immediately to purchase a new Trek bicycle and any gear they want. Those applying in-store will be able to possibly ride away on their new bike by the end of the day. Potential online buyers will then be directed to the Trek website, where they can finalize their purchase by using applicable financing that has been approved the payment obligations for the Trek Credit Card or Citizens Pay Line of Credit are covered in detail as well, including a look at interest-only and promotional offers when they utilize these finance options.

Understanding APR and Monthly Payments

You need to understand that when you are evaluating Trek financing your APR is going to carry an impact on how much money do you actually spend per month. The annual percentage rate (APR) is the yearly cost of borrowing, shown as a proportion that includes interest and charges. Trek Financing (powered by Citizens Pay), has competitive APRs, but allows for a variable rate based on your credit and current promotions. Please be aware that promotional offers may have a change to 0% APR for a limited period then switch back over to standard, purchase or balance transfer (as applicable) ANRs after the promo ends.

The monthly payment is based on the total amount financed, APR and length of term. In response, Trek Financing typically provides competitive repayment terms and a variety of monthly payment options to match the typical customer budget. If you use promotional financing (such as an interest-free offer for 12 months), it is important to know all of the terms. These promotions usually require the balance to be paid in full within that time frame or interest will begin racking up. Considering both the APR and monthly payment choices, cyclists can make a knowledgeable choice that enables them to be out on their brand-new Trek bike without extending themselves financially.

| Key Term | Definition |

| APR (Annual Percentage Rate) | The yearly cost of borrowing expressed as a percentage, including interest and fees |

| Promotional Financing | Special offers like 0% APR for a specified period |

| Standard Financing | Regular APR applicable after promotional period ends |

| Monthly Payments | Based on total amount financed, APR, and financing term; can be tailored to fit various budgets |

What Are the Advantages of Using Trek Financing?

Increasing Your Buying Power with Trek Credit

Buying power is one of the major advantages for riders who use Trek Financing. Using the Trek Credit Card or Citizens Pay Line of Credit a customer can afford better models and options that may be too expensive for an outright purchase. This purchasing strength lets cyclists put money into top of the range Trek bikes that excel in efficiency, durability and technology all of which can add to a better riding experience so they start out cycling career stronger.

Most importantly, it still increases the purchasing power even further beyond just the bike. Trek Financing allows customers to package accessories, gear and other Trek products with their purchase for a complete cycling solution. By taking that holistic route they ensure, naturally enough, all riders are properly kitted out — from the buy per se to helmets and lights through to cycling apparel. This meant by extending the cost out over a period of time it would mean that cyclists could make wiser decisions based on their needs, as opposed to immediate budget constraints. In turn this activated more engaged and completed cycling setups meaning better satisfaction etc.

Convenient Payment Options for Your Dream Bike

With a deposit-based financing option powered by Citizens Pay, Trek Financing makes it easy to pay for your dream bike on terms that work best with any lifestyle. With payment flexibility, cyclists get to pick a plan that fits their wallet and cash flow enabling every cycling enthusiast who aspires high quality Trek cycles. Consumers may choose a longer term to reduce their monthly payments, or they could shave interest costs by selecting the shortest loan option available. This flexibility makes the payment of a Trek bike more lightweight and allows bikers to have their new cycle without making too much effort.

Furthermore, Trek Financing frequently offers promotional deals that increase the convenience of payment even more. Those can be, among others, no interest for however many months on qualifying purchases (12-months-no-interest-financing) or great pay-in-full offers. These offers allow you to pay over time without additional fees as long as the balance is paid in full before the end of a promotional period. In addition, online account management and automatic payment programs make it even easier for customers to repay the financing over time so that they can get back out on a Trek and enjoy more riding.

Financing Accessories and Trek Products

Not limited to bikes, Trek financing can help with all accessories and products from the company. This holistic approach means cyclists can create a total riding system to suit their individual requirements and desires. Safety gear such as helmets and lights, performance enhancing accessories like cycling computers or power meters—basically anything else you want to add on can be part of your financing plan. A complete end-to-end financing solution that provides the flexibility so many rides can afford to be safer on their bike without making sacrifices due to finances.

What is more, the capacity to fund Trek accessories and further products provides chance for cyclists in order that they are able to update into high quality equipment with each other. Riders evolve in their journey and they may require to get advanced gears, components or specialized equipment. Trek Financing lets you to make extra investments without having to spend a large sum when buying the trailer causa. This flexibility provides cyclists with the freedom to keep making their rides more comfortable, faster and loaded up with Trek’s latest tech over time – all while easily staying within budget by spreading out payments.

How Do I Qualify for Trek Financing?

Credit Score Requirements for Trek Financing

All Trek Financing applicants: Must meet the credit score minimum set by Citizens Bank, which is part of approval for this financing program. Although Walmart has not disclosed a specific credit score threshold, you will likely need at least fair-to-good credit to have the best chance of being approved. Credit scores commonly fall from 300 to be able to 850… You are the range better than six hundred excellent. Still, Trek Financing is designed to be as inclusive a service as possible and factors other than credit score are considered when applying.

Pro Tip: Depending on your credit score, you may even qualify for Trek Financing without being in the upper echelon. Factors such as your income, employment status and current debt are taken into account according to the program. This well-rounded approach to credit evaluation is why customers with all types of financial situations may be approved.

If you’re unsure based on just preliminary information like what’s listed here, this can be for the reason that with these very short reviews your main eligibility check is what they termed a soft pull. Keep in mind, a healthy credit record of paying your bills on time and managing the bankroll can increase its chance of approval as well as make it pocket friendly for you.

The Credit Approval Process Explained

Trek Financing, powered by Citizens Pay has a streamlined and simple process that delivers credit decisions in minutes. The system also conducts a rapid credit check to establish your eligibility when you apply online or in-store. Among other things, the evaluation looks at your credit score (to see if you can pay back a loan comfortably), income level and stability of employment along with debts already owed to finance companies. The idea is not just for a lender to find out if you qualify for finance, but how much credit limit and under what terms can they offer based on your financial picture.

A ream of personal details — from your name and address to birth date, social security number. They also ask for information, such as your income and employment. This information is processed in an automated system that quickly cross-references it with credit bureau data once submitted. If approved, you’ll be given details on your credit limit, the annual percentage rate (APR), and any promotional offers.

Take the time to review these terms before agreeing. There are also instances where further investigation may be needed, pushing your approval time even longer. These results should not be interpreted as a guarantee nor indication that an individual will become eligible for the product, but only to provide it in reason with potential options around meeting those requirements;

What Should I Know About Trek’s Promotional Financing Offers?

Understanding 12-Month Promotional Financing

The 12-month savings offer is an especially popular one — it lets customers finance their purchase over a year without any interest. Usually valid on qualifying purchases, this deal is a great way to get that top-of-the-line Trek bike or full cycling setup for less. This offer requires customers to make regular minimum payments, but no interest accrues if the entire balance is paid off within 12 months from when it was opened. This structure offers some flexibility and might be good for people with the ability to pay off their entire balance within a year.

However, the terms of this promotional financing are important to understand. If the total is not paid in full within 12-months, interest will usually be charged from purchase date at standard APR. Careful budgeting is key, and on-time payments are crucial to realizing the full value of this offer. Also, paying only the minimum may not be enough to completely pay off your balance at the end of that 0% promotional period.

Trek and Citizens Pay recommend to customers that they calculate the amount of their monthly payments so as not to be left with an outstanding balance once the promotion ends, which would create interest charges; making sure you get all benefit from this financing opportunity.

Terms and Conditions of Pay-in-Full Promotions

These pay-in-full promotions available with Trek Financing are designed to offer customers interest-free financing for a predetermined length of time. Typically, these promotions require the whole payment to be paid within a given time frame such as 6,12 or even as long of an offer period. The advantage of these promotions is that there is no interest as long at the balance is paid in full by end of promotional period. For customers who can pay off the balance in full by that time, this allows for savings versus typical financing.

Customers must understand completely the terms and conditions of these pay-in-full promotions. If the balance is not paid in full by then, interest is usually applied retroactively from the date of purchase at a standard APR. This means that what little balance might be left will mean you have to pay much more in interest. In order to take full advantage of these promotions, customers need to use the built-in payment calculator feature and determine what it will cost per month for a balance free from end-of-promotion consequence.

Invest Now with Trek Travel trips booked by August 31, a minimum purchase value is required and it applies only to certain Trek or accessory products. Before you take the pay-in-full promotion, be sure to read all of the required terms and conditions in full so that they line up with your financial strategy as well as cycling requirements.

Where Can I Apply for Trek Financing?

Applying Online vs. In-Store at Trek Bicycle Stores

Credit can be applied for either online through the Trek website (www.trekcaptial.com) or in-store by a participating retailer. The online application process is built for accessibility to suit applicants that can apply from their homes at any time. Especially if you are already well-versed on your new Trek bike and easy to buy. The online application process is a simple and user-friendly one, with the system guiding applicants through each step required for an express decision in most cases. A good option for someone who wants to stick with a digital process, or lives too far from one of their Trek store locations.

All Trek Bicycle Store in-store applications are completed online-speed up your application by reviewing what is required on the applying with Credit Checking manifold. In-person engagement with knowledgeable staff provides a direct connection between customers and the bikes, as well as financing advice.

In-store applications are especially useful for anyone who has any questions about the financing process or need help selecting a bicycle What’s more, in-store applications can be processed within an hour allowing customers to ride away on their new Trek bike the same day. Online and in-store applications usually deliver rapid credit decisions, which facilitates an almost instant process to consummate the purchase no matter how you proceed.

Finding the Right Trek Financing Option for You

Determining which is the proper Trek Financing method to match (or balance) your current financial state, tune-up necessities and future aspirations. Both the Trek Credit Card and Citizens Pay Line of Credit have benefits that make it hard to choose one over the other, but whether you opt for a simple charge card or a more versatile line of credit is sort of up to how often you anticipate buying new bike gear.

You will want to take a close look at the terms, APRs and any current promotional options associated with each opportunity. You need to take into account how much you are able and willing to pay up front, add the price of your also desired trek accessories cost as well thus weighing it all against what the monthly payments will be.

Leverage what resources are there for you to make the right decision via Trek and Citizens Pay. It can involve offering online calculators that provide estimates of monthly payments, detailed FAQ sections and access to live people who are available via chat or phone with whom the customer may converse. If you have questions about the terms, possible fees or how different financing options will affect your credit ask them.

Keep in mind that the objective is to secure financing for your dream Trek bike while ensuring it fits in with your overall financial health. Some municipalities also offer cash-for-clunkers programs that fund a grant for money, which is enough to pay up another year. You may notice some noise at the outside when running or idling and this can be coming from roaming hubcaps; just stop them by replacing these using Tundra wheel cover items. —Maintain your engine correctly: Especially before driving longer distances you need certainly to conduct an everyday oil check/replace, etc.

READ MORE ARTICLES HERE: HTTPS://RAASHQ.COM/

FAQ

Q: What are Citizens Pay financing for Trek

A: A payment option available through Bicycles and more that allows you to buy the Trek you want today and pay over time. If approved, you will then have access to the Trek credit in order to make your purchase. It will let you buy your dream bike and pay in monthly installments over the period of time.

Q: What are the benefits of trek financing?

A: Trek finance offers many advantages such as buying now and paying later, starting at 0% APR for qualifying purchases. This means additional purchasing power with the Trek credit, enabling you to put nice bike sooner. Additionally, you can use your line of credit for other purchases at a later time so that you can add peripherals or new kit more affordably down the road.

Q: I want Trek financing, just tell me how to get it and when will my application be approved?

A: Submit financing application online or via Trek retailer. The application procedure is incredibly straightforward and usually involves merely a few moments. You will most likely get the approval and quoted offer within moments. As soon as you are approved, your line of credit will be available for you to make a purchase immediately

Q: What is the least and most a can I finance?

A: The Trek credit card is affiliated with several lenders, though in general it offers financing for at least $499 of eligible purchases. Up to your approved credit limit That covers everything from parts to top-end bikes so it is a huh range in which anything can be financed.

Q: Are there any Costs involved in funding Trek?

A: Certain eligible promotional offers may be 0% APR and have no annual fee for a selected amount of time. Nonetheless, you should always check your line of credit contract to see what types of fees — like late payment charges or finance costs — can be imposed. Once the promotional period ends, standard purchase APR rates apply.

Q: What online purchase can use Trek Financing or that has to be a store?

A: Renaissance Credit Scores are good for financing online and in-store purchases, while Trek Financing is done just at purchase. Use your credit and put it toward purchases on the Trek website or come in to one of our participating Trek retailers. This will give you the flexibility to shop however is easiest for you.

Q: How does Trek financing stack up with Klarna and other alternatives?

A: Trek financing and Klarna offer the ability to finance your purchase, but only Trek offers their custom program for ordering a new bike. It features has go some new to a few competitive costs, present stretching conditions as well as support buy subsequent purchases. Plus, Trek financing is backed by Citizens Pay—trusted and secure payment technology partnered with a top-five U.S. bank to provide you an easy application process that offers reasonable rates for your new cycling gear

Q: What if I fail to pay for an item during the promotional period?

A: If you cannot pay off your balance within the promotional period (which is frequently 12 months on qualifying purchases), standard purchase APR will attach to any unpaid portion of a remaining balance Be sure to schedule your payments correctly so you do not owe more interest. But fret not—your line of credit agreement will spell out the terms and conditions so you can plan your payments like a pro.